Meetings in 2014:

January | February | March | April | May | June | July | August

September | October | November | December

Meetings in

2013:

January | February | March | April | May | June | July | August

September | October | November

Nov. 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday November

17th,2022

Uncertain Times are GOOD Times to Buy. Most People do not like Uncertainty and do nothing until the market has clear direction. By then the REAL BARGAINS are gone.

You will Learn:

What is with this SHOCK and AWE Economy ?

Why this may be one of the BEST times to Buy and Invest

How will this Current Market Cycle Likely Play out...

How do you determine ARV- after repaired Value in a DECLINING Market?

Understand the Differences between using GOOD Debt Vs BAD Debt

How to use Equity Financing Vs Debt Financing

A Surefire way to Raise Private Financing Funds

Cash Flow Generating Tips &

Tricks During these Uncertain Times

And So Much More

Don't Miss this Very informative meeting, get your questions answered and enjoy Quality Networking with other Like Minded individuals.

Oct. 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday

October 20th,2022

Andy Teasley is teac-hing a full weekend course on Yield based investing Live and in person in the San Francisco, CA Bay Area. We'll begin Saturday morning with basic instruction on using the HP10bii financial calculator.During this section you'll learn the 5 buttons on the calculator that will change the way you look at every transaction.

We’ll say it again: you don’t need zillions of dollars, or great credit, or to take on a full-time, highly taxed wholesaling or retailing “job”, to create big monthly cash flow.

Andy Teasley has done just that, using a combination of creative buying strategies, lower cost properties, notes, and a firm understanding of the math of constructing deals, for many years—and now he’s bringing that vast, valuable experience to us (well, a VERY SMALL Group of us, anyway), in a live, 2-day, in-person workshop class.

This will be a Lively Hands On Class with Students Attending of all Experience Levels.

And NO, you don’t have to be an experienced real estate investor to use this strategy,

because Andy’s got 2 days to break it down into bite-sized, understandable, actionable

chunks for you.

Here’s a taste of what you’ll know when you leave:

•How to “begin with the end in mind” by using a simple financial calculator figure out payments, interest rates, yields, terms, and the best “numbers” for any deal

•How to buy your properties subject to the existing loan, or on lease/options, or using wrap mortgages, so that you put little to no money down up front

•How you can outbid every one of your competitors on every property, and even OVERPAY and still get lots of cash flow

•How notes work, and how you’ll use them to make your deals ‘hands-off’, and how you can use them to get any money you DID put down back right away

•How to use the “Ten for Twelve” technique to get a 35% rate of return (none of your so-called competitors know about this)

•How to do all of this i & n your tax-free retirement, education, or health-care plan

•The basics of finding and rehabbing property and mobile homes to create KILLER Returns

This will be a Lively Hands On Class with Students Attending of all Experience Levels.

You will Learn Powerful Negotiating Techniques and how to close ANY deal and KNOW its

yield

Because of the Interactive Nature of this Workshop, Class Size will be limited.

Grab

your Seat NOW before they are Gone and also take advantage of the

EARLY BIRD

Discounted Tuition and PRE-Register!

Sep. 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday

September 15th,2022

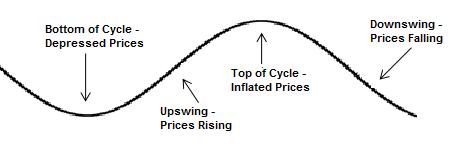

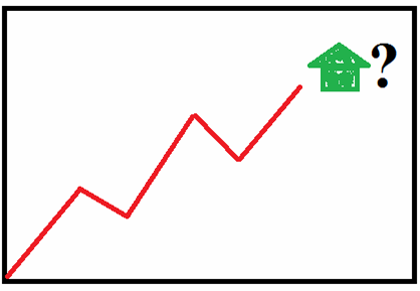

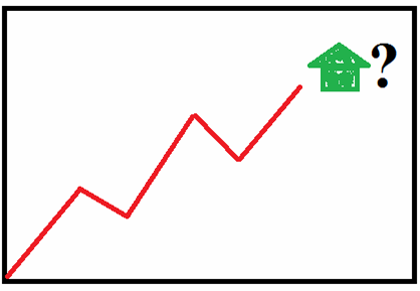

Up, Down or

Sideways- There are Opportunities to be Found in Each of these Real Estate Market

Scenario's

Up, Down or

Sideways- There are Opportunities to be Found in Each of these Real Estate Market

Scenario'sJuly 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday July 21st,2022

Are You finding that skyrocketing contractor prices are putting the squeeze on your profits? Stating the Obvious; According to Forbes, we are seeing the largest yearly increase of inflation in over 40 years. We are ALL feeling it in many sectors of our lives. Now more than ever, is the time to closely manage your rehab processes to reduce your expenses while crushing it in your design choices. Its important to get more BANG and Pizazz for your BUCKS.

Learn the Right way to approach Analyzing MLS Data & Trends

• Why did Subject Property A sell for $150k over, while Subject B sold for $40k over

•

Finishes that won’t break your bank, but will break records

• Understanding Design Trends

in your area

• Knowing what designs compliment or clash with each other

• Additions

versus Rehabbing

• How to figure out if it is worth the cost

• What are Builders

using?

• Walking new buildings to understand trends

• Hiring a Designer- Should

you?

• Do not trust your contractor to act as your designer

• Do not Design based on

your likes and dislikes

• Do not Design with your feelings. Design with Data.

• How to

maximize your design if you can’t afford a designer

• Don’t reinvent the wheel

• 5

simple hacks to help you Negate the Rising costs of construction

About the speaker:

Diana is Founder, Designer, and has oversight of

client relationships with DG Design Group;

www.dgdesigngroup.com She consults homeowners

through the overwhelming process of home renovations by walking them through a proven

system. She has done over 100 renovation projects in the last decade, which has given her a

profound knowledge base and consistent success within the Real Estate Investment Industry.

She was formerly the Co-Founder at Artemis Investments focusing on Acquisitions, Extensive

Renovations, and Syndication. At age 33 she founded the successful real estate brokerage

Vault Realty Group, a Real Estate Brokerage firm that focused on real estate investors,

which was later acquired by Century 21 Real Estate Alliance.

Diana is a published author and continues to present at speaking engagements all over the Bay Area advising new and seasoned investors on how to be a profitable VALUE ADD investor in any market. Diana has been featured and/or quoted in WSJ, BBC, Forbes, Associated Press and several other national publications in regards to the real estate market, investments and economy.

June 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday June 16th,2022

Do you know that the Calif. Energy Commission as of 1-1-2020

is requiring ALL Newly

Constructed residential homes must have Solar panels installed.

The rules make

California the first state in the nation to require solar panels on new homes.

Join us this evening to learn the IN's and OUT's about Solar power.

Solar

energy is a renewable and non-polluting source that is steadily becoming more

popular.

Our speaker this evening will cover its many applications and uses; the

various types of systems,

power options, equipment, aesthetics tips, costs to savings,

etc.

This is a wonderful opportunity to Listen, Learn and Get your Questions addressed

about

using or going Solar! - Don't Miss It !

You will Learn about the many facets of using Solar Power;

* Residential, Commercial, pool heating, vehicle chargers, energy storage,

battery

back up, and generators.

* How does the Actual Design and Installation process work?

* Are all panels being sold and installed the same?

* Can you cut your ties with PG&E forever...

* What are the Financing options or incentives that are available...

SPEAKER - Keith Kruetzfeldt

Keith along with his Father Paul

both with engineering backgrounds own

and operate Suntegrity Solar.

Suntegrity

Solar has focused exclusively on solar since 2009. Since then, they have installed over

1000+ solar systems. They are authorized Enphase Premium Installers, LG Pro Installers,

and Certified Tesla Installers. They have seen the proliferation of Solar uses over the

years and also many providers, and installers that sadly have come and gone.

May 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

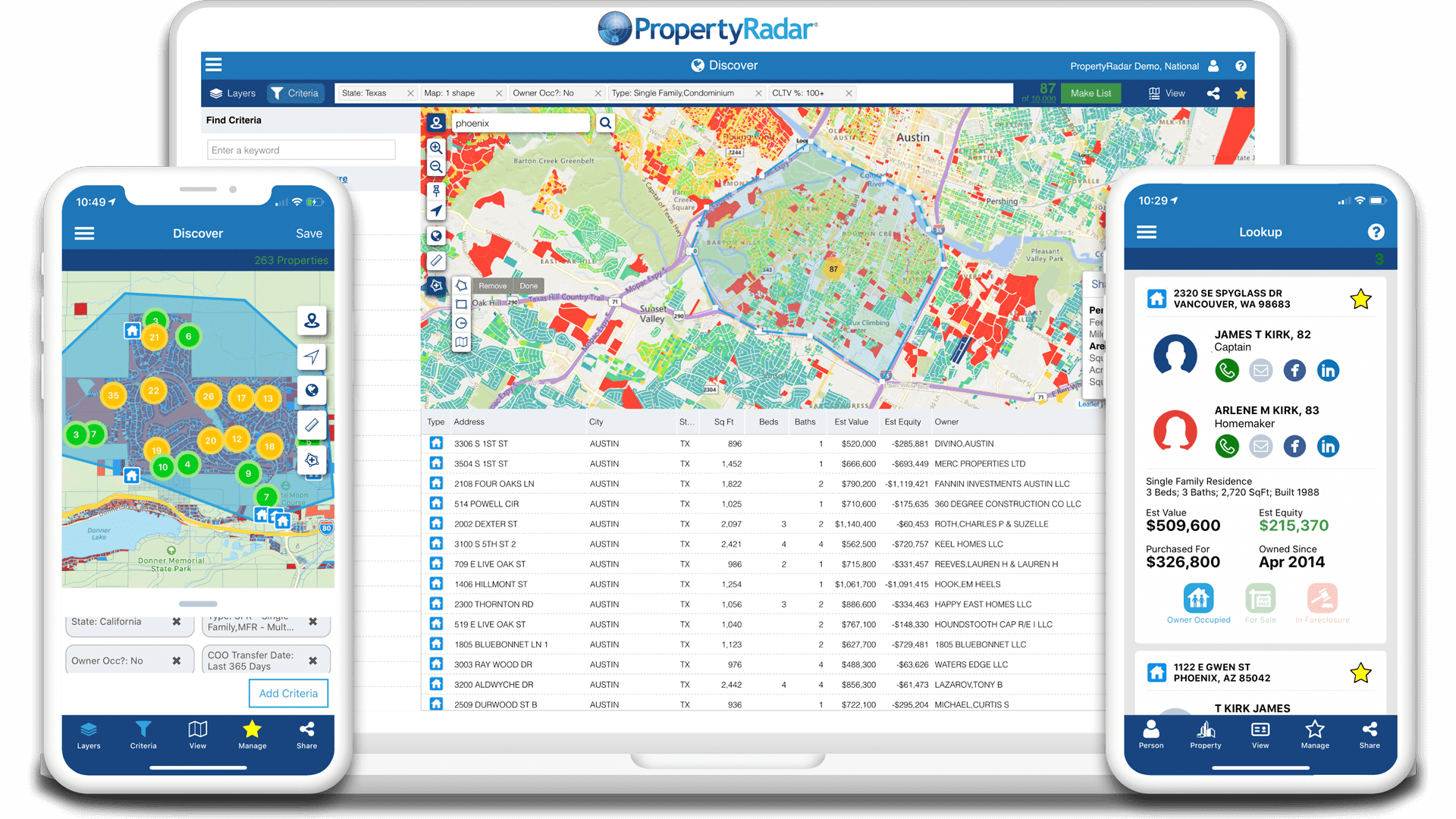

What you will Learn at this Meeting:

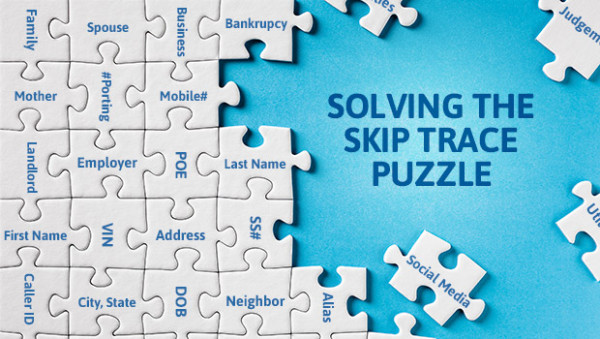

* What is Hyperlocal marketing?

* How to stand out from the competition

* What it really takes to buy off-market

* Where are the pandemic foreclosures?

* Will there be a housing market correction and are you ready?

Learn to find GREAT Opportunities using Data...

Learn to better Target potential

Prospects

Regardless of whether you are a Realtor or an Investor

using Big Data Correctly can

result in more consistent deal flow for you!

About PropertyRadar

PropertyRadar is the property data and owner information platform that real estate and home services professionals depend on to discover new opportunities to grow their business directly using enhanced public records data.

PropertyRadar makes available the same customer and market information that big business leverages daily, in an affordable, small-business friendly platform.

For more information and a free trial, visit PropertyRadar.com.

Company Contact:

Facebook:

https://www.facebook.com/PropertyRadar

Twitter:

https://twitter.com/PropertyRadar

LinkedIn:

https://www.linkedin.com/company/propertyradar

Email: [email protected]

About Sean O'Toole

After a successful technology career in Silicon Valley, Sean purchased and flipped more than 150 residential and commercial properties, nicely exiting the market before the credit bubble burst. Combining his technology and real estate experience Sean launched ForeclosureRadar in 2007, well before most realized a foreclosure crisis was coming. The service was quickly recognized as the nations best foreclosure information source and helped tens of thousands of real estate professionals succeed in a market which was otherwise devastating. Sean then launched PropertyRadar in 2013 and has since helped thousands more small businesses uses public records to discover new customers and grow their business.

Sean O'Toole Contact:

Facebook:

https://www.facebook.com/sean.p.otoole

Twitter:

https://twitter.com/seanotoole

LinkedIn:

https://www.linkedin.com/in/seanotoole/

Email: [email protected]

Apr. 21st 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday April 21st,2022

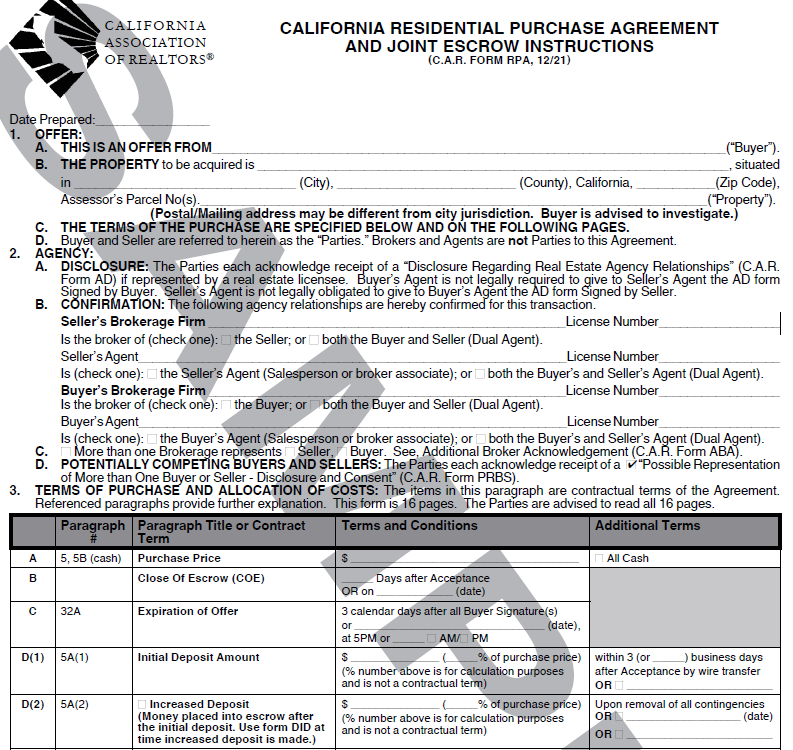

As a BUYER if you've written or as a SELLER you've received any offers on a property lately chances are you've noticed how the CAR - California Association of Realtors RPA - Residential Purchase agreement has undergone major editing and changes at the start of this year. Many clauses and language that previously existed in the prior agreement used for years is now gone, has been reworded or has been reformatted and converted to a new CHECKBOX format and the the RPA has also grown to now 16 pages in length.

As is always the case with any written legal contractual agreement whether BUYING

or SELLING a property you should have an understanding of what you

are are obligating yourself to do or not do. They are many "minefields" contain in

these agreements which can often trigger or create problems and lead to disagreement and

litigation that you should be aware of.

Whether you are a Broker, Realtor or

Real Estate Investor; Join us this month as our speaker will give us a summary

and unravel the changes that have taken place with the New CAR RPA format and as an expert

litigation witness share with you some of the "hot button" areas that often lead

to misunderstanding and costly remedies that she sees when working with Attorneys and the

Courts to sort out such issues.

NOTE: All Attendees will be given a SAMPLE copy of the New CAR -

Residential Purchase Agreement and Joint Escrow Instructions document.

ABOUT OUR SPEAKER

Cari’s had an amazingly successful career as a real estate broker, manager, and past

President of the Marin Association of Realtors. She’s earned national designations of GRI,

CRS, CRB, CCIM, and a Distinguished Service Award. She owns Professional

Publishing www.propubforms.com where

you can download any type of real estate form for a few dollars.

Cari’s authored

three books, dozens of courses, and taught GRI as a Master Faculty Instructor for the

Professional Realty Institute.

Cari does real estate litigation advisory services for attorneys. They hire her to testify in trials whether a real estate agent has acted properly - or improperly.

Cari will have a complimentary gift for you: a Sample copy of the new CAR RPA contract. She has also brought her landmark real estate reference book “Don’t Shoot Me…I’m Just the Real Estate Agent!” and will autograph your own copy for $20.

Mar. 17th, 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday March 17th,2022

Real Estate is a relationship based business, so we welcome all levels of Real Estate investors - newbies and experienced to come and learn time-saving processes that will help you maximize your investments as well as build your network. Whether you're looking for expert advice or simply want to connect with other like-minded individuals this is the meetup for you!

Who is Abbas Mohammed:

Real Estate investor involved with over 1500

apartments

Among the Top 1% Real Estate Brokers in the US

Abbas started out in the

Real Estate business as a REALTOR and quickly grew his business to become one of the top

agents in the US in a few years. After having delegated his business activities to a high

level, he switched his focus to investing in Real Estate and started buying large apartment

complexes and raising millions of dollars from investors to invest in key locations and

markets that are rapidly growing.

Last year, The Abbas Group completed over 37 Million dollars of acquisitions in multifamily and continues to rapidly grow and invest in high quality locations and properties across different locations!

Feb. 17th, 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday February 17th,2022

Short Notice but we had to reschedule our speaker for a later

month.

This Months Thursday Regular BAWB meeting is a Q & A format

we have

not done in quite some time.

COVID 19 - Threw us here in the SF Bay area and

around the country a real "curve ball".

Many events unfolded that most

thought were not possible.The real estate markets reacted in ways that most experts are

still puzzled by. After many decades; the term

Inflation has now once again become a

household word.

Some of you have stayed cooped up, or traveled out of the area, some of your have decided

to sit on the sidelines, some of you have taken massive action and not let a pandemic go

to waste.

Are we are a point in time with Real Estate of Irrational Exuberance and

are there still Savvy Investments to be had?

Whether you're a seasoned pro, just starting out newbie, a builder, developer, contractor, realtor, wholesaler, rehab expert, or rehab wannabe; pick the collective brains of our attendees and experts.

Anyone and Everyone can attend!

Join

us THIS Thursday evening 2-17-2022 for some insights on the market, where it may be

heading, Marketing techniques, Alternative Financing, SAFE ways to do business in our

current environment, Asset Protection, Options, Negotiating, and your chance to probe some

of our guest attendees with your pressing real estate questions. Nothing will be off

limits.

Jan. 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday January 20th,2022

COVID Safety Measures and Requirements

Masks required thru 2-15-2022 per State

Guidelines

Event will be indoors

If at the time of our Live In Person Events - the State of California and / or Marin County require face masks be worn indoors then we will follow and request you to follow their guidelines.

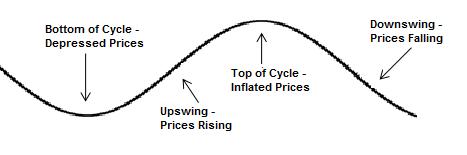

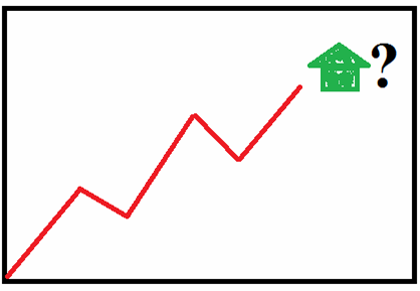

Is this still a GOOD Time or the the Right Time to Buy?

Have we reached the TOP in

Price Growth of this CRAZY frenzied Real Estate Marketplace as many experts are starting to

say?

OR

Is the CA and SF Bay Area Real Estate Marketplaces

and Prices poised to continue to climb even further (albeit more slowly) ?

Can this

stabilization of the Real Estate Marketplace achieved continue on for the LONG TERM as some

industry experts / Realtors are advocating?

How will the FED's current policy

towards Interest rates and Inflation affect us?

What about the soon to end Statewide

Moratoriums on Evictions and Foreclosure laws and other restrictive State Legislation?

Will OUTBOUND population migration from CA continue?

What is looming over the

Horizon?

DO NOT MISS THIS

MONTHS Thurs. Evening 1-20-2022 MEETING!

Speaker:

Investor, Educator, Real Estate

Economist, Statistician and

Author of Timing the Real Estate Market;

Robert Campbell

Program

Director's Note:

"Robert has spoken at our meetings many times

in the past and has been incredibly prescient in accurately predicting California Real

Estate Market trends.Don't miss his insights at this months meeting…”

The Campbell

Method: A Proven Timing System that Tells You EXACTLY When to Buy and Sell Real Estate

to Make Maximum Profits!

The Campbell

Method: A Proven Timing System that Tells You EXACTLY When to Buy and Sell Real Estate

to Make Maximum Profits!

Dear Real Estate Investor:

Imagine for a moment how you would feel if you could predict major turning points in the

real estate market.

Suppose somebody handed you a 30+year time-tested system

that would tell you ahead of time when property values were going to hit a peak …

and then when prices were going to hit bottom years later.

If you could anticipate these kinds of critical real estate events in advance …

then not

only could you make spectacular profits, but you could protect your money as

well.

Sounds pretty amazing, doesn't it?

Actually, it's not. The real estate market does signal its future intentions if you

know where to look.  Hello. My name

is Robert Campbell and I wrote Timing the Real Estate Market to help both

professionals and ordinary people make the most money in real estate with the least amount

of risk.

Hello. My name

is Robert Campbell and I wrote Timing the Real Estate Market to help both

professionals and ordinary people make the most money in real estate with the least amount

of risk.

I also have my web Site; www.realestatetiming.com Based on a major breakthrough in tracking and predicting real estate trends, my book reveals the real estate timing technique that I call The Campbell Method .

As far as I know, The Campbell Method is the only proven method in the world that shows how to accurately anticipate upcoming changes in your local real estate market.

What this means is that when you read Timing the Real Estate Market , you are going to learn how to make and protect your fortune in real estate in the same way that J. Paul Getty, the Rockefeller's, Warren Buffett, and other super-rich investors made their fortunes: by focusing on WHEN to buy and sell.

It's true. When

it comes to making money

in real estate, nothing beats good

timing.

The reason that The Campbell Method is going to change the way you think about how to buy and sell real estate is that I share my truly remarkable discovery of five key real estate indicators. I call them Vital Signs, and they're able to predict the peaks and valleys of real estate cycles with an almost uncanny accuracy. As leading indicators to what's looming on the horizon for real estate prices, these Vital Sign indicators act like windows into the future, giving you advance notice of approaching trend changes from three to six months before they become obvious to the general public.

Author's Note: Timing the Real Estate Market is used at the University of San Diego by Professor Elaine Worzala. The class: Real Estate Investment. "The logic behind these Vital Sign indicators is air-tight," says Professor Worzala. "I'm very impressed, and my students love your book."

Copies of Timing the Real Estate Market Book will be available for purchase and autograph by Robert Campbell at the meeting.

Its been called a "Thief in Disguise"! and also a

Silent Tax on Everyone!

For More Detailed Information about this Workshop or to

Register CLICK HERE

s

Dec. 16th, 2021

Also Don't Forget our ONGOING Live In Person

Jan. 2022

BAWB Regular Monthly Meeting

This will be a LIVE IN PERSON MEETING

6:30 Pm Networking Begins - So Come Early if you can

7:00 Pm the Formal Meeting starts

and ends by approx. 9:00 Pm

Thursday January 20th,2022

Is this still a GOOD Time or the the Right Time to Buy?

Have we reached the TOP in

Price Growth of this CRAZY frenzied Real Estate Marketplace as many experts are starting to

say?

OR

Is the CA and SF Bay Area Real Estate Marketplaces

and Prices poised to continue to climb even further (albeit more slowly) ?

Can this

stabilization of the Real Estate Marketplace achieved continue on for the LONG TERM as some

industry experts / Realtors are advocating?

How will the FED's current policy

towards Interest rates and Inflation affect us?

What about the soon to end Statewide

Moratoriums on Evictions and Foreclosure laws and other restrictive State Legislation?

Will OUTBOUND population migration from CA continue?

What is looming over the

Horizon?

DO NOT MISS THIS

MONTHS Thurs. Evening 1-20-2022 MEETING!

Speaker:

Investor, Educator, Real Estate

Economist, Statistician and

Author of Timing the Real Estate Market;

Program

Director's Note:

"Robert has spoken at our meetings many times

in the past and has been incredibly prescient in accurately predicting California Real

Estate Market trends.Don't miss his insights at this months meeting…”

The Campbell

Method: A Proven Timing System that Tells You EXACTLY When to Buy and Sell Real Estate

to Make Maximum Profits!

The Campbell

Method: A Proven Timing System that Tells You EXACTLY When to Buy and Sell Real Estate

to Make Maximum Profits!

Dear Real Estate Investor:

Imagine for a moment how you would feel if you could predict major turning points in the

real estate market.

Suppose somebody handed you a 30+year time-tested system

that would tell you ahead of time when property values were going to hit a peak …

and then when prices were going to hit bottom years later.

If you could anticipate these kinds of critical real estate events in advance …

then not

only could you make spectacular profits, but you could protect your money as

well.

Sounds pretty amazing, doesn't it?

Actually, it's not. The real estate market does signal its future intentions if you

know where to look.  Hello. My name

is Robert Campbell and I wrote Timing the Real Estate Market to help both

professionals and ordinary people make the most money in real estate with the least amount

of risk.

Hello. My name

is Robert Campbell and I wrote Timing the Real Estate Market to help both

professionals and ordinary people make the most money in real estate with the least amount

of risk.

I also have my web Site; www.realestatetiming.com Based on a major breakthrough in tracking and predicting real estate trends, my book reveals the real estate timing technique that I call The Campbell Method .

As far as I know, The Campbell Method is the only proven method in the world that shows how to accurately anticipate upcoming changes in your local real estate market.

What this means is that when you read Timing the Real Estate Market , you are going to learn how to make and protect your fortune in real estate in the same way that J. Paul Getty, the Rockefeller's, Warren Buffett, and other super-rich investors made their fortunes: by focusing on WHEN to buy and sell.

It's true. When

it comes to making money

in real estate, nothing beats good

timing.

The reason that The Campbell Method is going to change the way you think about how to buy and sell real estate is that I share my truly remarkable discovery of five key real estate indicators. I call them Vital Signs, and they're able to predict the peaks and valleys of real estate cycles with an almost uncanny accuracy. As leading indicators to what's looming on the horizon for real estate prices, these Vital Sign indicators act like windows into the future, giving you advance notice of approaching trend changes from three to six months before they become obvious to the general public.

Author's Note: Timing the Real Estate Market is used at the University of San Diego by Professor Elaine Worzala. The class: Real Estate Investment. "The logic behind these Vital Sign indicators is air-tight," says Professor Worzala. "I'm very impressed, and my students love your book."

Copies of Timing the Real Estate Market Book will be available for purchase and autograph by Robert Campbell at the meeting.

Its been called a "Thief in Disguise"! and also a

Silent Tax on Everyone!

For More Detailed Information about this Workshop or to

Register CLICK HERE

Nov. 2021

November 23rd- Tuesday WEBINAR

THIS WILL BE A SPECIAL BAWB SPONSORED

VIRTUAL ONLINE ZOOM Meeting /

WEBINAR

TUESDAY November 23rd,2021

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm

PST

Michael Morrongiello is an active investor who specializes in Real Estate & Real Estate “Paper” investments. Known as having one of the most knowledgeable & creative minds in the paper business, Michael started creating paper as a result of his own Real Estate investment activities in the early 1980’s.

Michael is the author of; Paper into Cash – The Convertible Currency-the definitive home study course that assists you in structuring seller financed transactions while creating marketable Notes and The Unity of Real Estate and “paper” – a course book that outlines numerous real world in the marketplace transaction scenarios and solutions where Real Estate and Financing techniques involving “paper” can be effectively used.

Michael is also the program director for BAWB- the Bay Area Wealth

Builders Association- an educational support group for both the beginning and seasoned

real estate investor.

ANYONE & EVERYONE CAN ATTEND

Save $5.00 by PRE-REGISTERING

EARLY!

$15.00 for All Others if PRE-Registered

by

11:59 Pm PST on Sunday 11-21-2021

Thereafter $20.00 to Register.

VERY

IMPORTANT TWO STEPS-READ CAREFULLY

STEP # 1 -REGISTER THRU

EVENT BRITE

& PURCHASE A TICKET

You can Register by CLICKING HERE

STEP # 2 -You will

then receive in the Confirmation

email

Event Brite sends to

you a special ZOOM meeting URL

link and Meeting Passcode so you will be able

to attend

the Webinar.

SAVE that Zoom Meeting URL and Meeting Passcode

and

Mark it down in your Calendar!

NOTE: There will be no refunds if you are unable to attend the Webinar LIVE or stay

on

for the entire presentation but a LIMITED TIME Replay of the Webinar will

be made

available after the event to all registrants as long as

no recording technical glitches

occur.

Oct. 21st 2021- Thursday Evening WEBINAR

THIS WILL BE A SPECIAL BAWB SPONSORED

VIRTUAL ONLINE ZOOM Meeting /

WEBINAR

THURSDAY October, 21st,2021

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm

PST

Join us to LISTEN and LEARN the Wisdom from this successful Old Timer and some of the time tested strategies and investment philosophies he has followed and continues to share today

YOU WILL LEARN:

DO NOT MISS THIS EXTREMELY INSIGHTFUL DISCUSSION!

About Jack H. Fullerton- Real Estate Coach

Jack Fullerton was a

successful; internationally known Swimming and Water Polo Coach who NEVER played Water Polo

in High School. Through study and application he had taken his College teams to a number of

State and National Titles. He was named Water Polo Coach of the year for 1983. After earning

Bachelor and Masters Degrees at U.C.L.A., Jack continued to study under Olympic Coaches

until he was able to compete with his mentors. His education in real estate is equally as

extensive. He was a member of the Academy of Real Estate where he received the Pathfinder

Award. He has been listed in Who’s Who in Real Estate. In 1997 Jack received the MEA award

from the Phoenix Foundation. He was awarded the first "Rohny Award" in 2014.

Jack also worked with Jim Rohn as an Executive Marketing director for over 5 years where he

increased his knowledge of success and success principles.

After 8 years of investing in real estate part time he retired from his college position. That was over 38 years ago. Jack is the past author of Money Fundamentals Newsletter. For over 30 years he ran the Commonwealth of OC- Orange County Real Estate Club where many successful real estate investors and instructors have learned the principles of successful real estate investing. The Commonwealth was nationally known for its outstanding education. He presently manages his real estate investments, teaches and shares the principles of his success.

He started buying single family homes years ago as a college professor and coach. Jack has acquired personal wealth and knowledge through the study and practice of creative real estate. Known as a problem solver, he has acquired millions of dollars of real estate over the years.

Jack is a firm believer to be successful you must study success. He has shown by his results, in more than one field, anyone through study, increased knowledge, desire and application can become successful. Jack enjoys sharing and teaching these principles of success to others. He will show you some of his techniques he used to successfully invest in real estate while taking care of the other guy first. He will show you how you too can accomplish the same. His investment techniques DO NOT REQUIRE A GREAT DEAL OF MONEY.

Jack has become the 'Real Estate Coach'. His motto is 'CAN DO'. If a Water Polo Coach can, why can’t you become financially successful?

ANYONE & EVERYONE CAN ATTEND

Save $5.00 by

PRE-REGISTERING EARLY!

$20.00 for All

Others if PRE-Registered by

11:59 Pm PST on Sunday 10-17-2021

Thereafter $25.00 to Register.

VERY IMPORTANT TWO STEPS-READ CAREFULLY

STEP #

1 -REGISTER THRU EVENT BRITE

& PURCHASE A TICKET

You can Register by

CLICKING

HERE

STEP #

2 -You will then receive in the

Confirmation email

Event Brite

sends to you a special ZOOM meeting URL

link and passcode so you will be able

to

attend the Webinar.

SAVE that Zoom Meeting URL and Meeting Passcode and Mark it down in your Calendar!

NOTE: There will be no refunds if you are

unable to attend the Live Webinar

but a LIMITED TIME Replay will be made available

after the event

as long as no recording technical glitches occur.

Aug. 24th 2021- Tuesday Evening WEBINAR

THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE ZOOM Meeting / WEBINAR

TUESDAY August, 24th,2021

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm

PST

THIS

WILL BE A VIRTUAL

WEBINAR MEETING!

(However you must register to attend-

See Below for Details)

IMPORTANT:

We have VERY Limited Space in the Online Meeting Room and this event will SELL OUT

so to assure

yourself access PRE-Register ASAP.

ANYONE & EVERYONE CAN ATTEND

Topic:

CREATIVE DEAL

STRUCTURING

IN ACTION

With BILL COOK

In almost All parts of the Country we are seeing FRENZIED

Real Estate markets where there is a LOT of Money to be made AND also LOST. As our

EUPHORIC Real Estate Markets continue to chug along, more and more Buyers and Investors

continue to pay seemingly never ending HIGHER and HIGHER prices, often paying ALL CASH.

While that can be one acquisition strategy, it also is one of the RISKIEST ways to acquire

property.

Many believe creative deal structuring is about complicated,

impossible-to-understand contracts.

This

couldn’t be more wrong.

Dealmaking is about caring,

asking questions, listening, being curious, asking more questions, T-barring, letting your imagination run free, asking more

questions, and finally,reaching an accord that

works for all parties involved.

During this CONTENT DRIVEN Webinar and Bill Cook’s

discussion,

you'll learn why advanced

creative deal structuring is simple, but not easy.

Here are some of the question’s Bill will

answer:

Do Not Miss this VERY Valuable Discussion and Join us Tuesday Evening 8-24-2021 @ 7 PM PST (10 Pm EST)

About Bill & Kim Cook:

Bill and Kim are a husband and wife real estate investing team. Bill creatively constructed his first deal in 1990 in Shreveport, Louisiana. He and Kim have been teaching other investors do the same since 1997. They became full-time real estate investors in 1998.

Their investment portfolio consists of single-family rental homes, mobile homes, a small mobile home park, plus notes, options, and stocks.

They built their business square on the back of knocking on homeowners’ doors. Why? Because it’s the fastest, cheapest and most effective way to get face-to-face with homeowners and make written offers.

When door knocking, Bill makes between 10 and 15 written offers a day, 8 out of 10 sellers invite him in, and he finds 1 to 3 shadow sellers per day. Question: Does your marketing technique get you to the seller’s kitchen table 80% of the time?

Their core belief is that real estate investing is not about buying, selling or renting houses. It’s about helping people solve their real estate problems.

Around 1997, Bill discovered three great real estate investing teachers: Jack Miller, Pete

Fortunato and Dyches Boddiford. From that day to this, he and Kim regularly attend Pete’s

and Dyches’ classes. (NOTE: Jack passed away in 2009 after a legendary career.)

On

January 1, 2001, Bill and Kim founded North Georgia REIA in Cartersville, Georgia. Over the

next 14 years, their group grew to 2,400 members. It was one of the largest, most

successful REIAs in the country.

On January 1, 2002, Bill and Kim began writing a syndicated real estate investing newspaper column that was published weekly. Their column ran for 13 years.

In 2002, Bill and Kim began publishing The Equity. It was a monthly real estate investing newsletter that grew into a 28-page monthly newspaper.

On August 30, 2018, they sold their 34-acre horse ranch in Adairsville, Georgia and moved into their motorhome. They now are full-time RVers. They travel the country seeking adventure and the enjoyment of life. As they travel, Bill teaches creative deal structuring techniques at REIAs (Real Estate Investor Associations).

Four times a year, Bill and Kim offer the following multi-day seminars:

ANYONE & EVERYONE CAN ATTEND

Save $5.00 by

PRE-REGISTERING EARLY!

$20.00 for All

Others if PRE-Registered by

11:59 Pm PST on Saturday 8-21-2021

Thereafter $25.00 to Register.

VERY IMPORTANT TWO STEPS-READ CAREFULLY

STEP #

1 -REGISTER THRU EVENT BRITE

& PURCHASE A TICKET

You can Register by

CLICKING HERE

STEP #

2 -You will then receive in the

Confirmation email

Event Brite

sends to you a special ZOOM meeting URL

link and passcode so you will be able

to

attend the Webinar.

SAVE that Zoom Meeting URL and Meeting Passcode and Mark it down in your Calendar!

NOTE: There will be no refunds if you are

unable to attend the Live Webinar

but a LIMITED TIME Replay will be made available

after the event

as long as no recording technical glitches occur.

Aug. 24th 2021- Tuesday Evening WEBINAR

THERE WAS NO SEPTEMBER 16th 2021 MEETING

July 2021 THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE ZOOM Meeting / WEBINAR Log On a little Early if you can Thursday July 15th,2021 THIS WILL BE A VIRTUAL ANYONE & EVERYONE CAN ATTEND Investor, Author, Educator Bill Tan * Is this the End or the Beginning of the End * How can you make money right now? By understanding some of the various uses of Leases, Options, * What’s possibly the BEST opportunity RIGHT NOW! * What other opportunities are also available? Who is Bill Tan? Bill Tan, “The Barter Man”, is a real estate and mortgage investment expert with over 30 years of experience. His clients rely on his business insight and industry knowledge to buy and sell properties and identify secured investment opportunities which generate a substantial monthly income. Bill Tan specializes in putting the tough real estate and note deals. His ability to think fast and creatively to develop effective strategies continually amazes clients and students alike. As a former real estate broker and long-time real estate exchangor, Bill is a “transactioneer” with few equals for real estate and note deals. He is the president of the Los Angeles Real Estate Investors Association (LAREIA) and the former president of the San Diego Creative Investors Association (SDCIA), one of the largest in the country, and the San Diego Cash Flow Association, an association of cash flow investors. Bill continues to be a featured speaker in the real estate and mortgage investment industry. He makes presentations for local real estate and note groups, conferences and conventions nationwide and appears on many podcasts, webinars, radio and TV programs. Bill was honored with the 2012 Industry Achievement Award at the NoteWorthy National Convention for his contributions to the note industry. Bill also earned the designation as one of the few Master Brokers of the note industry for many years and was awarded the Equity Marketing Specialist (EMS) designation for exchanging. Tenacious, consistent, and professional, Bill brings his unparalleled market knowledge together with an extensive network of local, regional and national contacts. ANYONE & EVERYONE CAN ATTEND Save $5.00 by PRE-REGISTERING $20.00 for All Others if PRE-Registered by 11:59 Pm PST Thereafter $25.00 to Register. VERY IMPORTANT TWO STEPS-READ CAREFULLY STEP # 1 -REGISTER THRU EVENT BRITE STEP # 2 -You will then receive in the Confirmation email SAVE that Zoom Meeting URL and Meeting Passcode and NOTE: There will be no refunds if you are unable to attend the Live Webinar

7:00 Pm PST the Formal Meeting starts and ends by 8:30 Pm PST

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm PST

WEBINAR MEETING!

(However you must register to attend- See Below for Details)

IMPORTANT: We have VERY Limited Space in the Online Meeting Room and this event

will SELL OUT so to assure yourself access PRE-Register ASAP.

for this “UP” Market cycle?

Equity Appreciation Notes, etc.

and This is FREE to BAWB MEMBERS in GOOD STANDING

but ONLY IF YOU PRE-REGISTERED

on Monday 7-12-2021

& PURCHASE A TICKET

You can Register by CLICKING HERE

Event Brite sends to you a special ZOOM meeting link and passcode

so you will be able to attend the Webinar.

Mark it down in your Calendar!

but a LIMITED TIME Replay will be available as long as no recording technical glitches occur.

THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE

ZOOM Meeting / WEBINAR

Log On a little Early if you can

7:00 Pm PST the Formal Meeting starts and ends by 8:30 Pm PST

Tuesday May 25th,2021

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm PST

THIS WILL BE A VIRTUAL

WEBINAR MEETING!

(However you must register to attend- See Below for Details)

IMPORTANT: We have VERY Limited Space in the Online Meeting Room and this event will SELL OUT so to assure yourself access PRE-Register ASAP.

ANYONE & EVERYONE CAN ATTEND

Where do we go from here? Will interest rates increase?

Will prices continue to skyrocket?

Will there every be any inventory?

Is the Real Estate Market a Ticking Time Bomb at the moment?

These are the types of questions everyone seems to be asking themselves right now.

Join us as we will discuss a number of

implications including the following:

• Uncollected Rents, Delayed Forbearances & Foreclosures-

Is this the ticking Time bomb?

• Virus trending down, Vaccines trending up...what does it mean for Real Estate

• Key leading indicators that one should keep an eye on

• How long will this Supply – Demand housing shortage last?

• What are the prospects for another Real Estate Market Crash in the US?

About your Speaker Michael Morrongiello:

Michael an active investor, author, educator, has been investing in Real Estate since the early 1980’s through (6) Six different prior Presidential office holders and has experienced his share of upside and downside cycles. While he cannot 100% accurately predict real estate cycle changes (no one can) he has an uncanny sixth sense ability to notice changes before they happen.

ANYONE & EVERYONE CAN ATTEND

Save $5.00 by PRE-REGISTERING

$20.00 for All Others if PRE-Registered by 11:59 Pm

on Sunday 5-23-2021

Thereafter $25.00 to Register.

VERY IMPORTANT TWO STEPS

STEP # 1 -REGISTER THRU EVENT BRITE

& PURCHASE A TICKET

You can Register by CLICKING HERE

STEP # 2 -You will then receive in the Confirmation email

Event Brite sends a special ZOOM meeting link so you

will be able to attend the Webinar.

SAVE that Zoom Meeting URL and

Mark it down in your Calendar!

NOTE: There will be no refunds if you are unable to attend the Live Webinar

but a LIMITED TIME Replay will be available as long as no recording technical glitches occur.

April 15th, 2021

THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE

ZOOM Meeting / WEBINAR

Log On a little Early if you can

7:00 Pm PST the Formal Meeting starts and ends by 8:30 Pm PST

Thurs. April 15th,2021

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm PST

THIS WILL BE A VIRTUAL

WEBINAR MEETING!

(However you must register to attend- See Below for Details)

IMPORTANT: We have VERY Limited Space in the Online

Meeting Room and this event will SELL OUT so to assure yourself access PRE-Register ASAP.

The (proposed) BIDEN Tax Plan -

How will it Affect Real Estate & The Real Estate Investor

Speaker: Tax Attorney Extraordinaire

John Hyre, ESQ

Real Estate is an EASY Target for Congress.

The Decisions you Make Today could have

Significant Financial and Tax Consequences

for you in the Future!

Buckle UP- Changes are Coming!

* Build America Back Better or Will It?

* Favorable Capital Gains Tax Treatment - Guess Again

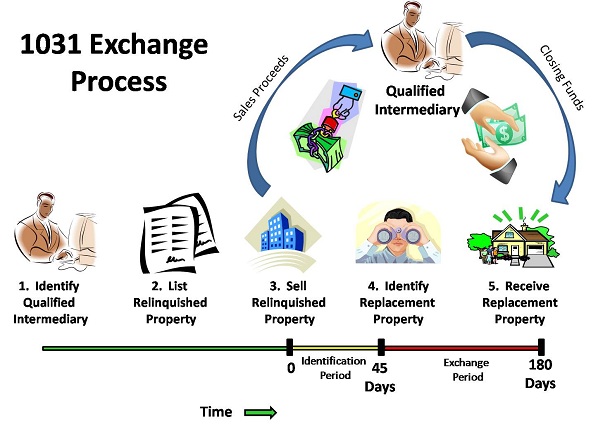

* What will happen with IRC section 1031 and Tax Deferred

Exchanges

* Will IRC Code section 121 survive?

* Will those who inherited a property still receive a

"Stepped Up Basis"?

* I Have a Highly Appreciated Property-What are some of my Tax

Strategies and options to avoid Taxation (confiscation)

* Is it Time to "Split" income and minimize Taxation ?

About John Hyre:

John Hyre is an exceptional tax attorney with 24 years of experience. Prior to venturing into private practice, John worked for a Fortune 500 company as Tax Counsel and for two of the “Big Three” accounting firms as a Tax Consultant. John has been involved in tax planning for start-ups, large corporate and partnership/LLC transactions, international transactions, REIT’s, and executive compensation arrangements. John also has extensive experience with the taxation of real estate and self-directed IRA’s and 401(k)’s. John has successfully defended such clients in IRS audits and Tax Court.

John frequently speaks on the topics of taxation of real estate investors and the taxation of self-directed IRA’s & 401(k)’s throughout the United States. John also invests in rental real estate. John is licensed in Ohio. Given the nationwide applicability of federal income taxation, John’s clients are from all areas of the United States as well as from overseas.

ANYONE & EVERYONE CAN ATTEND

Save $5.00 by PRE-REGISTERING

$15.00 for All Others if PRE-Registered by 11:59 Pm

on Sunday 3-28-2021

Thereafter $20.00 to Register.

IMPORTANT TWO STEPS

STEP # 1 -REGISTER THRU EVENT BRITE

& PURCHASE A TICKET

You can Register by CLICK HERE

STEP # 2 -You will then receive in the Confirmation email Event Brite sends a special ZOOM meeting link so you will be able to attend the Webinar.

SAVE that Zoom Meeting URL and

Mark it down in your Calendar!

NOTE: There will be no refunds if you are unable to attend the Live Webinar but a LIMITED TIME Replay will be available as long as no

recording technical glitches occur.

March 2021

SPECIAL MEETING - SPECIAL GUEST Wed. 3-31-2021 at 7 Pm PST

THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE

ZOOM Meeting / WEBINAR

Log On a little Early if you can

7:00 Pm PST the Formal Meeting starts and ends by 8:30 Pm PST

Wednesday March 31st,2021

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm PST

We had a last minute cancellation of our prior March Meeting so we are gonna make it up to you this month

with a VERY SPECIAL GUEST- SEE BELOW

THIS WILL BE A VIRTUAL MEETING!

(However you must register to attend- See Below for Details)

IMPORTANT: We have VERY Limited Space in the Online

Meeting Room and this event will SELL OUT so to assure yourself access PRE-Register ASAP.

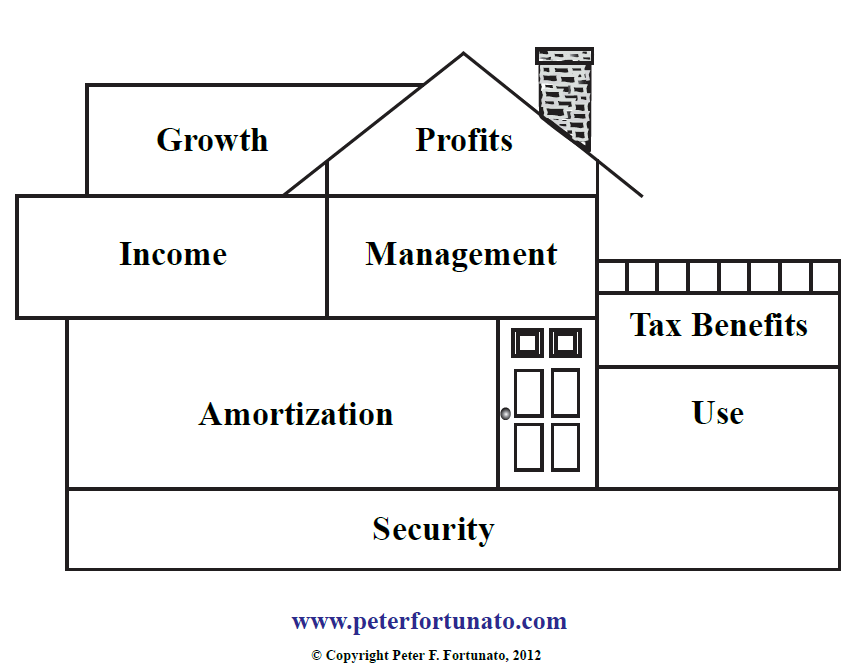

You've Got Questions

- Peter Has Answers!

Spend An Evening with Master Dealmaker Peter Fortunato

What Real Estate Issues are on your Mind?

We will cover these below issues and then

open it up for Interactive Q & A

*Are you Technique or Common Sense Driven when

Constructing a Transaction?

* Dealing with Tenants during Challenging Times

* Apartments Vs Houses and WHY?

* I have HIGHLY Appreciated Property or Know someone with

LOTS of Equity...What are my/their options to avoid a lot of

Taxation (confiscation)

ANYONE & EVERYONE CAN ATTEND

Save $5.00 by PRE-REGISTERING

$15.00 for All Others if PRE-Registered by 11:59 Pm

on Sunday 3-28-2021

Thereafter $20.00 to Register.

IMPORTANT TWO STEPS

STEP # 1 -REGISTER THRU EVENT BRITE

& PURCHASE A TICKET

You can Register by CLICK HERE

STEP # 2 -You will then receive in the Confirmation email Event Brite sends a special ZOOM meeting link so you will be able to attend the Webinar.

SAVE that Zoom Meeting URL and

Mark it down in your Calendar!

NOTE: There will be no refunds if you are unable to attend the Live Webinar but a LIMITED TIME Replay will be available as long as no

recording technical glitches occur.

Thursday February 18th,2021

THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE WEBINAR

Log On a little Early if you can

7:00 Pm PST the Formal Meeting starts and ends by 8:30 Pm PST

Thursday February 18th,2021

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm PST

THIS WILL BE A VIRTUAL MEETING!

(However you must register to attend- See Below for Details)

IMPORTANT: We have VERY Limited Space in the Online

Meeting Room so to assure yourself access PRE-Register ASAP.

Save $5.00 by PRE-REGISTERING

$15.00 for All Others if PRE-Registered by 11:59 Pm on Mon. 2-15-2021

Thereafter $20.00 to Register.

IMPORTANT TWO STEPS

STEP # 1 -REGISTER THRU EVENT BRITE & PURCHASE A TICKET

You can Register by CLICK HERE

STEP # 2 -You will then receive in the Confirmation email Event Brite sends a special ZOOM meeting link so you will be able to attend the Webinar.

SAVE that Zoom Meeting URL and Mark it down in your Calendar!

NOTE: There will be no refunds if you are unable to attend the Webinar but a Replay will be available as long as no recording technical glitches occur.

Dec. 17th 2020

Thursday December 17th,2020

THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE WEBINAR

Log On a little Early if you can

7:00 Pm PST the Formal Meeting starts and ends by 8:30 Pm PST

Thursday December 17th,2020

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm PST

THIS WILL BE A VIRTUAL MEETING!

(However you must register to attend- See Below for Details)

We appreciate your continued support throughout our 20+ years of hosting events. At some point this health crisis will eventually pass and a sense of normalcy will return. The BAWB - Bay Area Wealth Builders Association continues to extend sincere well wishes to you, your loved ones, your families and encourages you to be safe and vigilant during this Holiday Season and these uncertain times.

Its been VERY 2020!

As our year winds down and 2020 certainly has been one Helluva year to contend with we must

look forward To the coming New Year which will present all sorts of new

opportunities for both the new or astute Real Estate Investor.

Crash or Not to Crash?

No one can predict for sure what is going to happen in the coming year in

the real estate market, so now more than ever, it is time to get prepared.

THIS WILL BE A VIRTUAL WEBINAR MEETING!

ANYONE CAN ATTEND

This Will be a Virtual Online Webinar

Tues. 12-17-20 at 7 Pm PST Promptly

IMPORTANT: We have VERY Limited Space in the Online Meeting Room so to assure yourself access PRE-Register ASAP

This is FREE to BAWB MEMBERS in GOOD STANDING

$15 for All Others if PRE-Registered By 11:59 PM Tuesday 12-15-20

IMPORTANT TWO STEPS

STEP # 1 -REGISTER THRU EVENT BRITE & PURCHASE A TICKET

CLICK HERE

STEP # 2 -You will then receive in the Confirmation email Event Brite sends a special ZOOM meeting link so you will be able to attend the Webinar.

SAVE that Zoom Meeting URL and Mark it down in your Calendar!

November 2020

Tuesday November 17th,2020

THIS WILL BE A SPECIAL BAWB SPONSORED VIRTUAL ONLINE WEBINAR

Log On a little Early if you can

7:00 Pm PST the Formal Meeting starts and ends by 8:30 Pm PST

Tuesday November 17th,2020

Log On a little Early if you can

7:00 Pm PST Formal Meeting starts and ends by 8:30 Pm PST

THIS WILL BE A VIRTUAL MEETING!

(However you must register to attend- See Below for Details)

Spend an Evening Listening & Learning from Legendary Master Dealmaker

Peter Fortunato

The Elections are behind us, COVID persists,and change is inevitable...

Don't miss this opportunity to hear Peter's insights into what he and others are doing in today's ever changing Real Estate marketplace.

What is the BEST Strategy for You Today?

o Cash Flow Today or Profit tomorrow- You Choose

o What is Better- Great Terms or a Better price?

o Better location or more Cash Flow- What makes More Sense

o More Transactions or Fewer moving parts

o More entities or more insurance?

o Using a Lawyer or Drafting your own Documents

o Borrowing or lending LONG term or SHORT term

o Preparing for Inflation or Deflation-What Steps you might take

o Saving vs Spending

o IRC 1031 vs a Cash sale

THIS WILL BE A VIRTUAL WEBINAR MEETING!

ANYONE CAN ATTEND

This Will be a Virtual Online Webinar

Tues. 11-17-20 at 7 Pm PST Promptly

IMPORTANT: We have VERY Limited Space in the Online Meeting Room so to assure yourself access PRE-Register ASAP

This is FREE to BAWB MEMBERS in GOOD STANDING

$20 for All Others if PRE-Registered

IMPORTANT TWO STEPS

STEP # 1 -REGISTER THRU EVENT BRITE & PURCHASE A TICKET

CLICK HERE

STEP # 2 -You will then receive in the Confirmation email Event Brite sends a special ZOOM meeting link so you will be able to attend the Webinar.

SAVE that Zoom Meeting URL and Mark it down in your Calendar!

August 2020

Thursday August 20th,2020

THIS WILL BE A VIRTUAL ONLINE MEETING

Log On a little Early if you can

7:00 Pm Formal Meeting starts and ends by 8:30 Pm

Thursday August 20th,2020

Log On a little Early if you can

7:00 Pm Formal Meeting starts and ends by 8:30 Pm

THIS WILL BE A VIRTUAL MEETING!

(However you must register to attend- See Below for Details)

Strategies & How to Adapt in a

Changing Election Year Market!

Buckle UP - Get Ready!

Spend an Evening Listening & Learning from Legendary Master Dealmaker John Schaub

* Acquiring property strategically and profitably in any market

* Finding, recognizing and seizing opportunities that most investors miss

* Structuring to distribute cash flow

* Developing and maintaining million dollar relationships

* Ownership that provides protection, lowers your profile and reduces your risk of loss

* Retirement investment strategies to increase cash flow when you need it

About John Schaub

John Schaub has prospered during three recessions, four tax law changes and interest rates ranging from 6-16% in his 35 years as a real estate investor. His 2005 best-selling book, Building Wealth One House at a Time, assisted more than 100,000 real estate enthusiasts on their way to successful investing. His 2007 book, Building Wealth in a Changing Real Estate Market, is available online and in bookstores.

John recommends buying better, well-located houses rather than cheaper houses and other management-intensive properties. Better houses are more profitable and far less trouble. He advocates paying off debt, owning properties free and clear, and renting only to long term, high quality tenants.

John buys, sells and manages his own properties, and enjoys providing quality housing at fair prices for working families in his community. He teaches one Building Wealth One House at a Time seminar each year where students learn how to identify the best investment property in their town, how to buy it at below-market prices, and how to negotiate terms that guarantee a profit.

John also invests his time helping those who cannot afford to buy a home through conventional sources through his work with Habitat for Humanity and the Fuller Center for Housing. John has served for more than 20 years on the board of Sarasota Habitat, 7 years on Habitat's International Board and currently serves as the chair of the board of the Fuller Center for Housing.

John, a Florida native, is a proud graduate of the University of Florida, where he earned his B.A. from the College of Business Administration in 1970. He is an accomplished boat captain (power and sail), fisherman, skier (snow and water) and an instrument-rated pilot. John loves to travel, especially with his wife Valerie and their young adult children.

THIS WILL BE A VIRTUAL MEETING!

ANYONE CAN ATTEND

This Will be a Virtual Online Webinar

Thurs. 8-20-20 at 7 Pm PST Promptly

IMPORTANT: We have VERY Limited Space in the Online Meeting Room to assure yourself access PRE-Register ASAP

This is FREE to BAWB MEMBERS in GOOD STANDING

$20 for All Others if PRE-Registered

IMPORTANT TWO STEPS

STEP # 1 -REGISTER THRU EVENT BRITE & PURCHASE A TICKET

CLICK HERE

STEP # 2 -You will then receive in the Confirmation email Event Brite sends a special ZOOM meeting link so you will be able to attend the Webinar.

SAVE that Zoom Meeting URL and Mark it down in your Calendar!

August 4th - SPECIAL MEETING DATE / Webinar

THIS WILL BE A VIRTUAL ONLINE MEETING

Tuesday August 4th,2020

Log On a little Early if you can

7:00 Pm Formal Meeting starts and ends by 8:30 Pm

THIS WILL BE A VIRTUAL MEETING!

(However you must register to attend- See Below for Details)

We have VERY Limited Space in the Meeting Room

The GAME HAS CHANGED!

Want to find more deals?

STOP the Shotgun Marketing approach and learn ways to

Target Specific Audiences which Exhibit a HIGH probability

of NEEDING to Sell their properties

Wall Street played the data-driven real estate game successfully for years without much competition from Main Street local investors. But the game has changed. Today, Main Street pros can run circles around Wall Street if they learn the game.

Join Aaron Norris, VP of Market Insights at PropertyRadar as he uncovers and combines pandemic-frustrated real estate trends with the data-driven strategies investors are using to make money in 2020:

About Aaron Norris

Aaron’s real estate career started at five years old fixing houses in his father’s flip business. After living in NYC for almost a decade, he joined the family hard money business as a mortgage officer and researcher, producing numerous market timing reports and award-winning resources for the real estate community. Aaron writes where real estate meets technology on sites like Forbes.com, Think Realty Magazine, and BiggerPockets.com. He speaks nationally on technology, housing, and trends. Obsessions include ADUs, 3D printed homes, robotics, data with nuance, and the convergence of technology trends and their potential impacts on housing.

THIS WILL BE AN ONLINE VIRTUAL WEBINAR EVENT

We have VERY Limited Space in the Meeting Room

UPCOMING WORKSHOP

DON'T WAIT - PRE-REGISTER TODAY

FOR CRUSH IT! - With Real Estate 2020

Live All Day Sat. 7-18-2020

Corte Madera, CA

Michael Morrongiello's All Day Workshop

Taught only once a year!

Making a Million Dollars in Real Estate is No Longer an Option...instead its a necessity for surviving and thriving during these crazy economic times!

The Good News; with dedication and forethought, this current market is the

perfect market to achieve such a goal.

This fantastic educational event will focus on Finding Deals, Raising Money, Making Offers, Buying Right, Selling Quickly, and...How to Overcome the most common fears or misconceptions that can hold you back from making more money right now. Its for any beginning or seasoned active Real Estate entrepreneurs. There literally is something for everyone!

At This Workshop we will discuss in detail, and give examples of many of the following

Important Skill Sets you should be comfortable with:

Marketing – Online & Offline

Financing – including Traditional, Creative & Alternatives

Raising Private Money

Negotiations with Sellers & Buyers

Understanding Documentation & Paperwork

Deal Structuring

Tax Free Investing

Constructing “Profit Guaranteed” offers

And so Much More...

Including a SPECIAL DATA MINING

Presentation & Discussion

From a User Friendly Data Provider

(now you get easily obtain Phone #'s and Email Addresses for your

Targeted Prospects and more importantly Learn how to use them!)

PRE-REGISTER EARLY for DISCOUNTED TUITION

For More Workshop Details, Registration

and Lodging Information

CLICK HERE

June 2020

TIMES:

THIS WILL BE A VIRTUAL ONLINE MEETING

Thursday June 18th 2020

Log On a little Early if you can

7:00 Pm Formal Meeting starts and ends by 8:30 Pm

As we move away from our SIP Shelter in Place policies and attempt to return to some sense of a "New Normal" regardless of whether you are a seasoned Pro or just getting started you'll enjoy this discussion.

Michael Morrongiello, Program Director for BAWB - the Bay Area Wealth Builders Association one of the SF Bay Areas longest running REIA- Real Estate Investor Associations will be your Host and Instructor

We Will Cover:

* What is happening with our Real Estate Markets RIGHT NOW?

* What about in the near Future?

* The Difference between Active Vs Passive with your investments

* Genius Vs Luck...

* The LASER approach to investing

* What is the correct order of business that you MUST have straight

* A Skill Set that pays Tremendous Dividends you must learn

* A Few Case Studies

and So Much More....

THIS WILL BE AN ONLINE VIRTUAL WEBINAR EVENT

Show up early and be sure to obtain your ticket thru Event Brite

You can Pre-Register by clicking the below URL Link:

https://www.eventbrite.com/e/getting-started-in-real-estate-investing-pre-or-post-covid-tickets-109515327292

BAWB Regular Monthly Meeting -Thursday May 21st,2020

TIMES:

6:30 Pm Networking Begins- Come Early if you can

7:00 Pm Formal Meeting starts and ends by 9:30 Pm

THIS WILL BE A VIRTUAL ZOOM MEETING!

To Register Go to https://datadrivenrealestateinvesting.eventbrite.com

OR Click Here

The Next REGULAR

BAWB Monthly Meeting

is Thurs. May 21st, 2020

The World’s Most Valuable Resource

is No Longer Oil, but Data!

Data-driven Real Estate Investing in 2020

From Apple to Zillow, today, every market performance leader is a data-driven organization.

Real estate investing is no exception.

So what does the data-driven real estate investor look like in 2020...and beyond?

Join Sean O'Toole, CEO and Founder of PropertyRadar for his insights on the strategies to consider, and mistakes to avoid, to become a data-driven real estate professional.

• Pandemic real estate disruption. How can you apply frameworks to organize data-driven strategies, reduce anxieties, and get back to business as unusual?

*Big data vs small data. Math and machines. What are the data driven trends you should be aware of, and more importantly, most wary of?

• Don't get lost in the data. How do insights derived from hyperlocal market analysis uncover opportunities most frequently missed?

• Timing is Everything Now.Not too soon, and never too late. How can you leverage event-based data that uncover and drive opportunities at the right time?

• Chocolate and peanut butter. How do smart, data-driven real estate professionals combine unconventional sources of data with public records to uncover the best opportunities?

• The ongoing war for data supremacy. What are the existential threats to the data-driven strategies that real estate professionals and small investors depend on - and what you can and should do about it?

About Sean O'Toole

Sean O’Toole is CEO & Founder of PropertyRadar, the property data and owner information platform real estate pros have trusted since 2007 to do billions of dollars in deals. Sean got his start with data in Silicon Valley during the dot-com boom. After the dot-com bubble, Sean flipped properties for five years, and with data-informed insights, got out right before the housing bubble burst.

Sean launched ForeclosureRadar in early 2007 before anyone had heard of the foreclosure crisis, and relaunched ForeclosureRadar as PropertyRadar in 2013.

Today, PropertyRadar remains the go-to platform for data-driven real professionals and investors intent on leveraging comprehensive property data and owner information to grow their business directly. Try it for free at PropertyRadar.com.

THIS WILL BE A VIRTUAL ZOOM MEETING!

To Register Go to https://datadrivenrealestateinvesting.eventbrite.com

OR Click Here

MEETING COST: $20.00* for Non BAWB Members

*plus a small event brite registration fee

AND FREE to BAWB Members

DO NOT MISS THIS VERY POWERFUL DISCUSSION

AND INFORMATIVE MEETING!

**************

NEW DATE FOR UPCOMING WORKSHOP

(We have Reschedule the workshop for this date)

DON'T WAIT - PRE-REGISTER TODAY

FOR CRUSH IT! - With Real Estate 2020

Live All Day Sat. 7-18-2020

Corte Madera, CA

Michael Morrongiello's All Day Workshop

Taught only once a year!

Making a Million Dollars in Real Estate is No Longer an Option...instead its a necessity for surviving and thriving during these crazy economic times!

The Good News; with dedication and forethought, this current market is the

perfect market to achieve such a goal.

This fantastic educational event will focus on Finding Deals, Raising Money, Making Offers, Buying Right, Selling Quickly, and...How to Overcome the most common fears or misconceptions that can hold you back from making more money right now. Its for any beginning or seasoned active Real Estate entrepreneurs. There literally is something for everyone!

At This Workshop we will discuss in detail, and give examples of many of the following

Important Skill Sets you should be comfortable with:

Marketing – Online & Offline

Financing – including Traditional, Creative & Alternatives

Raising Private Money

Negotiations with Sellers & Buyers

Understanding Documentation & Paperwork

Deal Structuring

Tax Free Investing

Constructing “Profit Guaranteed” offers

And so Much More...

Including a SPECIAL DATA MINING

Presentation & Discussion

From a User Friendly Data Provider

(now you get easily obtain Phone #'s and Email Addresses for your

Targeted Prospects and more importantly Learn how to use them!)

PRE-REGISTER EARLY for DISCOUNTED TUITION

For More Workshop Details, Registration

and Lodging Information

CLICK HERE

BAWB Regular Monthly Meeting -Thursday March 19th,2020

TIMES:

6:30 Pm Networking Begins- Come Early if you can

7:00 Pm Formal Meeting starts and ends by 9:30 Pm

MEETING CANCELLED and CRUSH IT with Real Estate 2020 Workshop RESCHEDULED

With the unprecedented events unfolding around us surrounding the Covid19- Corona Virus we have made the decision to CANCEL this months Thurs. 3-19-2020 BAWB meeting and Full Day Sat. 3-21-2020 CRUSH IT with Real Estate 2020 Workshop event and adhere to calls from the health experts for social separation in an effort to slow down, hinder,and thwart possible transmission in larger public gatherings.

We have scheduled an alternative date of Sat. 7-18-2020 for the Full Day CRUSH IT with Real Estate 2020 Workshop event(More Details -See Below).

At some point this health crisis will eventually pass and a sense of normalcy will return.

The BAWB - Bay Area Wealth Builders Association extends sincere well wishes

to you,your loved ones,your families and encourages you to be

safe and vigilant during these uncertain times.

BAWB Monthly Meeting

is Thurs. 3-19-2020

THIS MONTH's MEETING CANCELLED!

Don't Miss this VERY Informative Meeting!

Joint Ventures: The Cheapest, Easiest, Fastest and Safest Alternative to Syndication

Most investors need other people’s money (OPM) to achieve their real estate goals.

The problem is that most investors incorrectly believe that

syndication is the only way to do deal with OPM.

Join us as “The Real Estate Investor’s LawyerTM, Jeff Lerman, explains in plain English

why, even though he helps investors with syndication, he believes joint ventures are the cheapest, easiest, fastest, and safest alternative to syndication.

By the end of his presentation, you will have learned:

His credentials include:

He has lectured at UC Berkeley Fisher Center for Real Estate & Urban Economics and the USC Law Center. He is Managing Partner of Lerman Law Partners. Jeff has been practicing law for 40 years and is the former general counsel for two national real estate syndication companies. He has published articles nationwide and is a highly sought-after speaker. He’s also a real estate investor and a real estate broker. You can visit his website at www.realestateinvestorlaw.com.

BAWB Regular Monthly Meeting -Thursday Feb. 20th, 2020

TIMES:

6:30 Pm Networking Begins- Come Early if you can

7:00 Pm Formal Meeting starts and ends by 9:30 Pm

The Next REGULAR

BAWB Monthly Meeting

is Thurs. 2-20-2020

(and will be a 2 Part Program)

IMPORTANT NOTE:

This Evenings Meeting will be held in the upstairs TERRACE room within the Hotel

| Part 1 | ||||

|

Ways to Tell If a Home |

||||

.jpg) A home with “good bones” is considered to be a good home with the potential to be a great home. It typically describes a neglected home or fixer-upper or some sort of deferred upkeep house (think: diamond in the rough) that features quality, well-made construction – hence the good bones meaning.

A home with “good bones” is considered to be a good home with the potential to be a great home. It typically describes a neglected home or fixer-upper or some sort of deferred upkeep house (think: diamond in the rough) that features quality, well-made construction – hence the good bones meaning.

We often see potential home owners and investor entering the rehab arena take on projects that can prove time consuming and very costly. It can be hard to know whether a property is a potential “money pit” or a true diamond in the rough. This month we will cover some of the go too features to look for when scouting out properties.

**************************************

| Part 2 | |||

| There is Little Cash Flow with Rentals in CA ... |

|||

Have you heard that Statement before?

While it has become more and more apparent that its difficult to pick up SF Bay area or CA investment properties that will readily cash flow we will share several techniques

that can be utilized to create cash flow in virtually any market.

This will include Analysis of a deal structured specifically so that it will cash flow

YES even here in the SF Bay Area.

Don't Miss this VERY Informative TWO Part Meeting

UPCOMING WORKSHOP

DON'T WAIT - PRE-REGISTER TODAY

FOR CRUSH IT! - With Real Estate 2020

All Day Sat. 3-21-2020

Corte Madera, CA

Michael Morrongiello's All Day Workshop

Taught only once a year!

Making a Million Dollars in Real Estate is No Longer an Option...instead its a necessity for surviving and thriving during these crazy economic times!

The Good News; with dedication and forethought, this current market is the

perfect market to achieve such a goal.

This fantastic educational event will focus on Finding Deals, Raising Money, Making Offers, Buying Right, Selling Quickly, and...How to Overcome the most common fears or misconceptions that can hold you back from making more money right now. Its for any beginning or seasoned active Real Estate entrepreneurs. There literally is something for everyone!

At This Workshop we will discuss in detail, and give examples of many of the following

Important Skill Sets you should be comfortable with:

Marketing – Online & Offline

Financing – including Traditional, Creative & Alternatives

Raising Private Money

Negotiations with Sellers & Buyers

Understanding Documentation & Paperwork

Deal Structuring

Tax Free Investing

Constructing “Profit Guaranteed” offers

And so Much More...

Including a SPECIAL DATA MINING

Presentation & Discussion

From a User Friendly Data Provider

(now you get easily obtain Phone #'s and Email Addresses for your

Targeted Prospects and more importantly Learn how to use them!)

PRE-REGISTER EARLY for DISCOUNTED TUITION

For More Workshop Details, Registration

and Lodging Information

CLICK HERE

Jan. 2020

BAWB Regular Monthly Meeting - Thursday January 16th 2020

TIMES:

6:30 Pm Networking Begins- Come Early if you can

7:00 Pm Formal Meeting starts and ends 9:30 Pm

A Powerful program you do not want to miss!

Is this still a GOOD Time or the the Right Time to Buy?

Have we reached the TOP in Price Growth of this CRAZY frenzied Marketplace as many experts are starting to say?

OR

Is the CA and SF Bay Area Real Estate Marketplaces and Prices poised to continue to climb further (albeit more slowly) ?

Can this stabilization of the Real Estate Marketplace achieved continue on for the LONG TERM as some industry experts / Realtors are advocating?

How will the FED's current policy towards Interest rates affect us?

What about the new Statewide Rent Control law and other restrictive State Legislation?

Will OUTBOUND population migration continue?

What is looming over the Horizon?

DO NOT MISS THIS MONTHS Thurs. 1-16-2020 MEETING!

Speaker:

Author of Timing the Real Estate Market,

Statistician, & Investor;

Robert Campbell

Program Director's Note:

"Robert has spoken at our

Meetings in the past and has been incredibly prescient in accurately predicting California Real Estate Market trends.Don't miss his insights at this months meeting…”

The Campbell Method: A Proven Timing System that Tells You EXACTLY When to Buy and Sell Real Estate to Make Maximum Profits!

The Campbell Method: A Proven Timing System that Tells You EXACTLY When to Buy and Sell Real Estate to Make Maximum Profits!

Dear Real Estate Investor:

Imagine for a moment how you would feel if you could predict major turning points in the real estate market.

Suppose somebody handed you a 29-year time-tested system that would tell you ahead of time when property values were going to hit a peak … and then when prices were going to hit bottom years later.

If you could anticipate these kinds of critical real estate events in advance … then not only could you make spectacular profits, but you could protect your money as well.

Sounds pretty amazing, doesn't it?

Actually, it's not. The real estate market does signal its future intentions if you know where to look.  Hello. My name is Robert Campbell and I wrote Timing the Real Estate Market to help both professionals and ordinary people make the most money in real estate with the least amount of risk.

Hello. My name is Robert Campbell and I wrote Timing the Real Estate Market to help both professionals and ordinary people make the most money in real estate with the least amount of risk.

I also have my web Site; www.realestatetiming.com Based on a major breakthrough in tracking and predicting real estate trends, my book reveals the real estate timing technique that I call The Campbell Method .

As far as I know, The Campbell Method is the only proven method in the world that shows how to accurately anticipate upcoming changes in your local real estate market.

What this means is that when you read Timing the Real Estate Market , you are going to learn how to make and protect your fortune in real estate in the same way that J. Paul Getty, the Rockefeller's, Warren Buffett, and other super-rich investors made their fortunes: by focusing on WHEN to buy and sell.

It's true. When it comes to making money