|

|

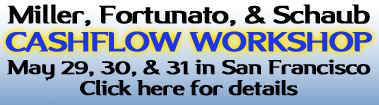

Join Peter & John and attendees from all over the country as they teach this ONE TIME class on the West Coast; Markets are Transitioning, but the future of the economy is still uncertain. You can’t predict the future, but you can be ready for it. Come learn strategies for building cash flow and your estate whether we have inflation, deflation or a meltdown. Is Capitalism really where it is at? Peter and John survived, prospered, and helped their students make money with real estate and notes in every market since 1975. This is a wonderful opportunity to Listen and Learn from two of the best and most creative Real Estate Educators / Instructors around. Don’t Miss this Meeting; invite a family member, your spouse, loved one, business associate, etc. and bring them along- they will be glad you did. The BLOCKBUSTER EDUCATIONAL

|

|

|

June 21st 2012 Meeting

The California

Great Depression of 2012

SPEAKER:

Stephen Frank

Don't miss this insightful discussion about many of the woes our Great once "Golden State" faces and thoughts for remedy.

You will learn about:

- Our Stagering State Government deficit and debt

- The upcoming Government Pension System Collapse

- The Detrimental Affects on local government (hence Real Estate property values)

- What are the real Reasons for our State's Problems

- Do we have any real Solutions?

Who is Stephen Frank?

He is a long time political activist Human Rights Activist (Freedom is a human right) (Foodie-devotee to The Food Network)

- Born December 2, 1946 in The Bronx, New York

- Graduated from Los Angeles HS and LA City College

- Served in Viet Nam, First Infantry Division

- Received my B.S. from the University of Redlands

- Married for 39 years to my wife Leslie , an educator.

- Has two daughters, Emily 32, a graduate from UC Davis Law School and Amy 32, received her MBA from Pepperdine. And a grand daughter

- Publisher California Political News and Views (capoliticalnews.com)

- Guest 3-5 times per week on various talk radio programs, including segments on KSFO, San Francisco, Brian Sussman show every Monday at 7:05am.

He has worked with numerous Charity Groups, along with D.C. based organizations from Americans for Tax Reform, NRA, and many of the supporting groups of CPAC

Upcoming

Peter Fortunato

FULL DAY Workshop you don't want to miss!

Pre-Register early to get Discounted tuition and a FREE BONUS copy of Jack Miller timely book; "Financial Strategies in Uncertain Times"

Workshop Info:

Using Skill Sets & Currencies to Acquire Assets and Generate Income

If your have certain "Skill Sets", are already in business or aspire to be in business – Pete will cover and discuss the use of Inventory, Investments, and Promises as "Currencies" that can be used other than cash in Business building and in Estate building.

Learn how to acquire Assets and Inventory which can be resold to generate ordinary income and fund your lifestyle.

And

Learn how to acquire Investments which can be held for the production of Portfolio, Passive, and / or Tax advantaged Long Term Capital Gain Income to fund your lifestyle.

Some of the Topics Covered:

- Promises for Property

- Income for Use

- Services for Property

- Growth for Income

- Management for Growth

- Better Security for Better Terms

- Toys for Property

- Property for Property

- Amortization for Cash Flow

- Fixing for Profit

- Income for Yield

- Property for Debt Relief

- Modifications for Property

- Management for Income

- Options for Down Payments

This will be quite the valuable day! As always Pete requests you Challenge him, Ask Questions, and Offer Suggestions and Alternatives.

Don't Wait – Pre- Register Today!

BAWB

Regular Monthly Meeting Thursday May 17th 2012

A Two (2) Part Program

Part 1 - "Call me When you Find a GOOD Deal"

We've all heard this statement in the past... What does it really mean?

![]()

Learn

about the "ART" of the deal and Why that is so crucial in this frenzied market

to your success

Deal Structuring Tips and Tricks by Michael Morrongiello

Part 2 - Selling For Top Dollar in Today's Market

Do you Want to sell Your

Properties Quickly and for Top Dollar?

Do you Want to sell Your

Properties Quickly and for Top Dollar?

Attend this months meeting to learn insider secrets about how to properly prepare your home for resale.

With the demand for

Qualified Retail buyers intense and buyers becoming VERY picky you need to

bring your property to the market so that it stands out from competing

inventory.

Highlight your property strengths, downplay its weaknesses and appeal to the

greatest possible pool of prospective buyers with these Selling & Staging

tips.

Get your house looking its best and ready for sale within days. Learn Seamless

and economical orchestration of all the small and large details such as

landscaping, touch up, plumbing,electrical, gutter cleaning, clutter removal

and organizing, window washing, pressure washing, painting, storage,interior

design and yes STAGING are some of the services that will allow you to sell

your house fast and for the highest price.

- Creating a marketing plan for your property

- What are the most crucial days from a marketing standpoint

- What Technologies & Tools can assist you in marketing your property

- Photographic image tips and traps ...

- What Glue makes your deals stick

- Why Staging?

- Benefits of Staging- When & Where to Stage?

- What is the Value / Cost proposition

- Partnering with a Staging Firm

- Plenty of Q&A

About Yami Arvelo

Yami Arvelo, founder and designer of MOONES, Inc & MOONEShome, has a keen eye and over 20 years of experience in redesigning spaces, reinventing them and making them uniquely her own. She has renovated and facilitated sales of numerous residential properties in the San Francisco Bay Area from Tiburon to Silicon Valley. With equal parts style and vision, Yami is an interior designer with a strong team of builder contractors and handy man. Whether you are renting an apartment or living in a mansion, MOONES wants to help you create a space filled with pure style and luxury

... a place that will inspire you!

... a place that will inspire you!

Yami's work has been featured on INTERIOR DESIGN, DWELL, Modern Conteporary Furniture & Home Decorating, Home & Design, Design Journal and Seattle Life & Style publications to name just a few. To date, she has remodeled and staged more than one hundred high end homes and apartments in San Francisco and Marin counties. She has also designed and produced eco-friendly custom lighting for Caesars Palace Hotel Las Vegas, Yoshi's San Francisco, and private residences in Vancouver, Canada and Oahu, Hawaii.

She has revamped, remodeled and staged properties for a top Napa wine producer, Silicon Valley software developers, San Francisco Bay Area real estate brokers, developers/investors, international art collectors, and local artists. She is one of the most successful and devoted all-in-one designer and "turn-key-real estate solutions" providers in the Bay Area. Her work has gained recognition for Excellence in the ADEX 2005.

With her broad design background and international upbringing, Yami brings comfort, timeless style and value to each and every project she works on. Ms Arvelo's experience servicing international clients via innovation and stellar creative comes from her days at Contempo Design in Amsterdam, The Netherlands. Her extensive travels to Asia, Latin/North America, and Europe has influenced her metropolitan style and personal elan.

Thursday April 19th 2012

Its a new day and age in the world of Real Estate Finance.

Proper and timely funding is the grease the "squeaky wheel" continues to need in order for properties to continue to be bought and sold and for any chance of a housing recovery to take hold.

With mortgage lending activities severely restricted and the availabiltiy of funds for both buyers and sellers limited- this months meeting involves a panel of several different lenders who offer different niche lending programs that cater to activities such as:

* Fixer Upper Loans - both from an institiutional lender standpoint and from a private money lending vantage point.

* First Time and current Home buyers FHA, VA, and Conventional financing programs.

Does Title seasoning of ownership matter?

What about the HVCC- Home Valuation Code of Condut appraisal rules?

What are the various down payment and qualifying criteria?

* Investor loan programs for the investor looking for both Purchase and also Refinance Non Owner Occupied Investor properties

* Short & Long Term Private Money

lending

Short & Long Term Private Money

lending

* Hard Money- Asset based Lending

Its important to be aware of what is out there in the marketplace as it may affect you - regardless of whether you are an investor looking to acquire properties or to pull cash out through refinancings, or a seller seeking to get cashed out upon the resale of one of your properties.

Join us for what promises to be a very informative meeting.

Due Diligence for Real Estate Investors

Learn how to do your due diligence before you jump into a deal or a joint venture.

Reggie Lal will show you how to analyze the

numbers of a real estate deal to see if it is worth your time! Utilizing

Reggie's iron-clad Deal Analysis Template, you will learn how to analyze

all the possible numbers on a deal to decide if it makes sense. He will

also list resources and advice for doing your own due diligence on people,

deal structuring, joint ventures and organizations as well.

Reggie Lal will show you how to analyze the

numbers of a real estate deal to see if it is worth your time! Utilizing

Reggie's iron-clad Deal Analysis Template, you will learn how to analyze

all the possible numbers on a deal to decide if it makes sense. He will

also list resources and advice for doing your own due diligence on people,

deal structuring, joint ventures and organizations as well.

Speaker: Investor, Educator, Realtor, Lender; Reggie Lal

Discussion will touch these and other issues:

- Property Inspection

- Running the numbers

- Deal Structuring

- Securing the deal

- Working with partners

- Using the Proper paperwork

FULL DAY WORKSHOP

Sat. 3-17-2012

South San Francisco Conference Center

Buying & Selling Strategies for these Chaotic Times!

Many Investors are making a small fortune in your backyard using some

powerful marketing & investing techniques that will be taught at this

event.

- Create Long Term Wealth RIGHT NOW rather than Swapping Hours for Dollars

- Learn to Create your own Personal Economy with Cash Flow and Chunks of Cash

- Learn from Reggie Lal & Michael Morrongiello as they teach you various strategies to keep you on the cutting edge for this distress market and to keep you out of harms way.

- No Fluff or Theory - Actual techniques being used in this marketplace by these active investors to make deals happen.

- A Content Rich Event with High Quality Education & Discussion

- Great Networking

Discounted Tuition ONLY if you PRE-Register!

For more information about this Content Rich Workshop Event or to

PRE-Register go to this link;

http://www.bethesmartinvestor.com/Public/Events/Buying-SellingStrategies/index.cfm

IMPORTANT NOTE:

BAWB members can get the Member discount by using coupon code: BAWB2012

BAWB Monthly Meeting Thursday February 16th 2012

GOOD FLIP...BAD FLIP

Speaker;

Speaker;

Mary Morrongiello

Investor, Rehab Project Manager, Design

Consultant

If you in the Buy / Sell Business or you upgrade and renovate properties to enhance their value you don't want to miss this meeting and the discussion involving the tips, tricks, and traps that one needs to be aware of when involved in renovation projects.

About Mary:

Mary Morrongiello has renovated more than 70 homes. She has worked on

projects that required as little as $5,000 in renovation work to

projects costing as much as $800,000 to get to "market ready" and among

all of the destruction, decision making and restoration many , many

lessons have been learned. Continue to Kick off 2012 with what will be

the most candid, hard hitting, brutal presentation of the year! You do

not want to miss this speaker as she's got information you need...

delivered in an entertaining manner.

Among a few of the Topics to be discussed:

- How to quickly know if "The deal makes sense"…

- Common sense fixes that most idiots over look

- Talking yourself into a Bad deal (How and why we do this)

- Mistakes made

in 2011 (never to be repeated)

BAWB Thursday January 19th 2012 Meeting

Say Good Riddance to 2011!

Out with the OLD and in with the NEW YEAR...

Is this the Right Time to Buy? Have we reached the bottom of the Market as other so called experts are saying? Is stabilization of the Marketplace near?

The January Meeting will be held in San Francisco at:

Holiday Inn Golden Gateway

1500 Van Ness Ave

San Francisco, CA 94109

(415) 441-4000- Hotel Direct #

Start off the New Year Informed "listen and learn from our own industry expert"

Speaker: Author of Timing the Real Estate Market,

Statistician, & Investor; Robert Campbell

Speaker: Author of Timing the Real Estate Market,

Statistician, & Investor; Robert Campbell

Topic: 2012 Housing Forecast -What Will Happen & Why

Program Director Note: Robert has spoken at our meetings in the past and has been incredibly prescient in accurately predicting California Real Estate Market trends.Don't miss his insight at this months meeting…"

***********************************************

The Campbell Method: A Proven Timing

System that Tells You EXACTLY When to Buy

and Sell Real Estate to Make Maximum

Profits!

Dear Real Estate Investor:

Imagine for a moment how you would feel if you could predict major turning

points in the real estate market.

Suppose somebody handed you a 21-year time-tested system that would tell you ahead of time when property values were going to hit a peak … and then when prices were going to hit bottom years later.

If you could anticipate these kinds of

critical real estate events in advance … then not only could you make

spectacular profits, but you could protect your money as well.

Sounds pretty amazing, doesn't it?

Actually, it's not. The real estate

market does signal its future intentions if you know where to

look.

Hello. My name is Robert Campbell and I wrote Timing the Real

Estate Market to help both professionals and ordinary people

make the most money in real estate with the least amount of

risk.

I also have my web site; www.realestatetiming.com Based on a major breakthrough in

tracking and predicting real estate trends, my book reveals the real estate

timing technique that I call The Campbell

Method .

As far as I know, The Campbell Method is the only proven method in the world that shows how to accurately anticipate upcoming changes in your local real estate market.

What this means is that when you read Timing the Real Estate Market , you are going to learn how to make and protect your fortune in real estate in the same way that J. Paul Getty, the Rockefellers, Warren Buffett, and other super-rich investors made their fortunes: by focusing on WHEN to buy and sell.

It's true. When it comes to making money

in real estate,

nothing beats good timing.

The reason that The Campbell Method is going to change the way you think about how to buy and sell real estate is that I share my truly remarkable discovery of five key real estate indicators. I call them Vital Signs, and they're able to predict the peaks and valleys of real estate cycles with an almost uncanny accuracy. As leading indicators to what's looming on the horizon for real estate prices, these Vital Sign indicators act like windows into the future, giving you advance notice of approaching trend changes from three to six months before they become obvious to the general public.

Author's Note: Timing the Real Estate Market is used at the University of San Diego by Professor Elaine Worzala. The class: Real Estate Investment. "The logic behind these Vital Sign indicators is air-tight," says Professor Worzala. "I'm very impressed, and my students love your book."

Copies of Timing the Real Estate Market will be available for purchase and autograph by Robert Campbell at the meeting.

Thursday, December 15th, 2011

T his

is our final meeting of the year!

his

is our final meeting of the year!

DON'T MISS

OUR

"DOING DEALS HOLIDAY GATHERING"

This is always judged by our attendees to be one of the BEST meetings we have all year.

It's a great way to learn what others are doing, the genesis of their individual transactions, and more importantly where the profit centers are...you'll be amazed at how many different perspectives to doing a deal there are.

This also

will be a great meeting to get to better know your fellow attendees.

This also

will be a great meeting to get to better know your fellow attendees.

Come join us for a festive time of the year meeting and Holiday cheer in an open forum setting.

You are

invited to bring your spouse or a loved one for a night out and to better see

what our meetings are all about.

We have several BAWB members tell us their "deal story" which promises to be

informative and fun.

It's

been an incredible year filled with change, tough lessons, and

successes.

It's

been an incredible year filled with change, tough lessons, and

successes.

We hope some of you will share a hard lesson or success from the past year.

November

17th BAWB Meeting- A (2) Two Part Informative Program you simply do not want to

miss!

Part

1:

Doing Real Estate

Right

Making Big Money Close to Home in Good Markets or

Bad

Speaker: Local Investor; Richard

Kelly

- How to find high-profit deals within 30-minutes of your home

- How to find and buy from prospects with lots of equity

- How to make offers that will make you big money

- Negotiation techniques that will supercharge your deal

- How to find seller financing here in the Bay Area

- Step-by-step case studies of actual local deals

Richard Kelly is an investor who has grown his real estate business in his back yard -- right

here in the Bay Area. His focus is doing real estate right: keeping it simple

and profitable in good times and bad. His presentation will outline how he

finds and signs deals, and offer a step-by-step look case studies of his actual

deals, revealing how he did it, and how you can, too!

Richard Kelly is an investor who has grown his real estate business in his back yard -- right

here in the Bay Area. His focus is doing real estate right: keeping it simple

and profitable in good times and bad. His presentation will outline how he

finds and signs deals, and offer a step-by-step look case studies of his actual

deals, revealing how he did it, and how you can, too!

Richard Kelly has been a full-time real estate investor for the past six years.

Before switching into investment, Mr. Kelly worked was a journalist for 12

years. He has a BA in Economics and an MBA in Finance. A Canadian, he has

called the Bay Area home for the past 15 years.

**********************************************

Part

2:

The 10 Point Housing Recovery Plan!

Hey, Washington are you listening?

With Housing still struggling across the country and here in the immediate Bay Area our speaker will share his poignant thoughts on effective policy changes which if implemented could jump start a stabilization of this vicious downward spiraling housing market.

Here are a few:

- Repeal the over reaching Dodd- Frank Financial Services Regulation Bill

- Bring

back accelerated method Depreciation to encourage Real Estate ownership

and to soak up some of this excess inventory

- Lift the $25,000.00 limitation or ceiling on passive losses

To

learn and hear about the rest - be sure to visit with us!

October

20th 2011 - A Two Part Program

Part One -

Techonology Talk for Real Estate Agents & Investors

Whether your an investor or agent - Learn how to be more efficient in running your business, getting back to clients, customers, making offers, and handing day to day tasks and followup. Don't miss this insight.

Speaker; Investor Ford Chiang

A few topics to be covered:

-

Creative uses of Technology for small businesses

-

Digital signatures so you can sign anywhere

-

Telecommunications tools to stay connected

-

Into the cloud - files online, synchronization, aggregation

-

Social Networking- easy updating and finding friends a little easier

-

Making Craigslist a little better

-

Tracking expenses and accounts all in one place

About our Speaker:

About our Speaker:

Ford Chiang graduated from the University of California

with a degree in Economics in 1999 but

had a thirst for technology. He spent the next 7 years working in the IT industry in various

positions from technical support to

systems administration. At the turn of 2008 he quit a secure job at University of Calfornia because he

saw great opportunities in the real

estate market. Since then he has applied his technical experience in helping his family build a

portfolio of real estate rentals as

well as shared his knowledge with others in his field. Ford's personal experience has a heavy emphasis on

wireless technology, collaboration and

mobile tools.

Part Two -

The Repurchase Market - Looming Danger Ahead

About our Speaker; Mary Fricker

Mary Fricker is an independent journalist living in

Sebastopol who has retired after 20 years as a business reporter for The Santa

Rosa (Calif.) Press Democrat, including many years covering the real estate

beat. In 2010 she was awarded the McGill Medal for Journalistic Courage from

the University of Georgia for her work with the Chauncey Bailey Project in

Oakland, Calif. (www.chaunceybaileyproject.org). Among her awards are three

Investigative Reporters & Editors awards, the UCLA Gerald Loeb Award, the

George Polk award, several New York Times Company Chairman's Awards, the

National Headliner Award and an Associated Press award for best business

reporting. She was co-author of the New York Times best-selling book "Inside

Job - The Looting of America's Savings and Loans" published by McGraw-Hill

(1989) and HarperCollins (1990).

Mary Fricker is an independent journalist living in

Sebastopol who has retired after 20 years as a business reporter for The Santa

Rosa (Calif.) Press Democrat, including many years covering the real estate

beat. In 2010 she was awarded the McGill Medal for Journalistic Courage from

the University of Georgia for her work with the Chauncey Bailey Project in

Oakland, Calif. (www.chaunceybaileyproject.org). Among her awards are three

Investigative Reporters & Editors awards, the UCLA Gerald Loeb Award, the

George Polk award, several New York Times Company Chairman's Awards, the

National Headliner Award and an Associated Press award for best business

reporting. She was co-author of the New York Times best-selling book "Inside

Job - The Looting of America's Savings and Loans" published by McGraw-Hill

(1989) and HarperCollins (1990).

A Bad Rap for the Mortgage & Real Estate Industry's?

The real estate and mortgage industry has gotten a bad rap, as the cause of the financial crisis of 2007-2008. Yes, there were big troubles in real estate and in mortgage lending. But the most fundamental cause of the financial crisis in 2007-2008 was not subprime mortgages, it was the $5-10 trillion repurchase (repo) market, where giant financial institutions used subprime mortgage securities as collateral to get loans. When subprime borrowers began to default, the repo lenders panicked and stopped lending to the banks. That was the credit freeze that caused the crisis in September 2008.

In other words, the crisis was not caused by property owners borrowing too much money, it was caused by giant financial institutions borrowing too much money, much of it on the repurchase market.

Why should you care about this?

Some of the new rules for property transactions are not needed, since fixing mortgages will not prevent the next financial crisis if repo lenders panic over a different kind of collateral (like Greek debt) or hear a false rumor and panic for no reason at all.

To prevent the next financial crisis, we need to settle on reforms for the repurchase market.

Economists have made some suggestions. Visit with us as we talk about them. If nothing is done, expect more turmoil.

September 15th, 2011 BAWB Meeting Date

Speaker;

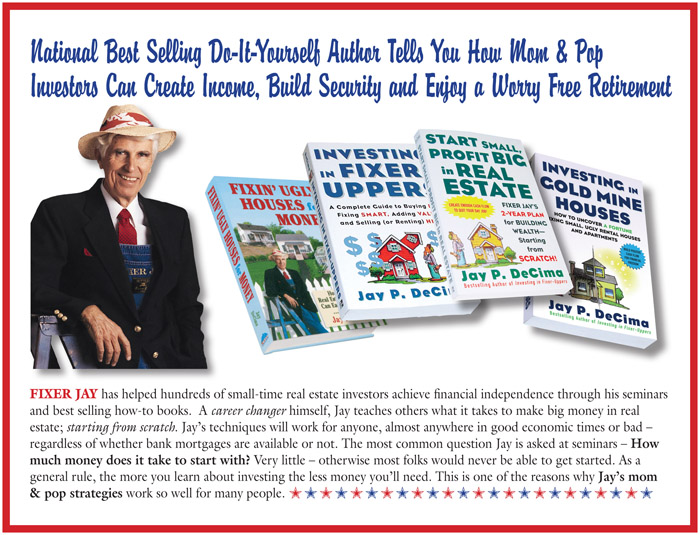

Author, Investor, Educator; "Fixer Jay"

Decima

INVESTING JAY'S WAY

MULTIPLE UNITS

(COLONIES)

Don't miss this rare opportunity to listen and learn from one of the old time masters and his wisdom involving the acquistion and management of small multi unit rentals. Make it out to this event and invite an associate, friend, family member, or loved one- they will be glad you did.

Learn About the 12 BENEFITS:

* RECESSION PROOF Property

* QUICKER CASH FLOW & MORE cash flow

* VERY LOW RISK

* IDEAL FAMILY BUSINESS

* HIGH DEMAND RENTAL UNITS

* YEAR ROUND INCOME

* SELLER FINANCING (MOSTLY without Banks)

* EZ EQUITY LOANS

* FAST EQUITY BUILDUP

* FINANCIAL INDEPENDENCE

* SELF EMPLOYMENT

* Building a WORRY-FREE RETIREMENT

August

18th 2011 Meeting

WORLD IN CHANGES...

We've got a lot to learn about you

too....

We've got a lot to learn about you

too....

The dog days of summer continue on as congress finally got their act together to raise our Nations debt ceiling.However instead of instilling confidence and stability to our economy- we've seen tremendous push back as skittish markets have reacted in a manner that was unthought of.

This is a First - We've never done this type of Meeting

format before

This is a First - We've never done this type of Meeting

format before

Tonights meeting will be a discussion of how folks like yourselves see the Real Estate Investment marketplace.

- Is stabilization near?

- Has the Housing market found a firm footing?

- What is going to happen to Interest Rates?

- When will the Jobs return?

- Whats up with consumer confidence...

- What is the Banks and

Asset Managers real game plan to

sort out this mess?

sort out this mess?

Attendees will share from their "perspective" and what Prism they are looking through their outlook about Real Estate and what does it tell them about the here and NOW and the Future.

We will try to make it an

interactive event with a "Town Hall" feel to it.

The focus is on current opportunities and what folks feel will be the

ones presenting themselves in the near future.

ADDED BONUS;

Speaker:

Author, Investor,

Educator

Greg Pinneo

will discuss:

"What our Entrepreneurial Focus should be in these uncertain economic times."

About Greg Pinneo

About Greg Pinneo

Gregory Pinneo is a Northwest native and a graduate of the University of Washington. For over 30 years Greg has been a full time real estate entrepreneur and has become a recognized expert in acquisition, finance, negotiation, property management, and the philosophical mindset that makes possibility a reality.

A natural entrepreneur and motivator, Greg gives his audiences a challenge to live a more deliberate life. His message is one of focus and possibility, as well as delivering sound tools to make these possibilities a reality in peoples' lives. His many students and seminar participants remain in touch and look to Greg as mentor and friend.

BAWB Monthly Meeting -Thursday July 21st

2011

Trust Concepts & Strategies

This meeting will expose you the wonderful world of Trusts

Come learn about Land Trusts, Personal Property Trusts, Title Holding Trusts and other Trust Vehicles that you can use for privacy and profit.

The Legendary Jack Miller once said:

"If there is ever a doubt about HOW to take title to a property- put it into a Trust"

Isn't it time you learn and understand the power of Trusts, Title Holding Trusts, Personal Property Trusts among others?

Well you can by Attending this evenings meeting and the fantastic Upcoming; TRUST STRATEGIES & CONCEPTS 2 day information packed Nuts and Bolts workshop with Dyches Boddiford and Guests. - Check out the link for more info and details about this NUTS & BOLTS info packed class.

Trust Strategies and Concepts to be held on Sat. & Sun. 7-23 & 7-24 at the South San Francisco Conference Center.

Tonights speaker is Investor, Educator, and Author; Dyches Boddiford

PLUS

Upcoming Workshop You do not want to Miss

Sat.

& Sun. July 23rd & 24th

This 2 day

workshop with Dyches Boddiford and Guests; including a Trust Attorney,

Title Company representative and others will give you a broad understandning of

the various types of Trusts, many of their uses for Real Estate and also

other asset types, and also the forms needed to save you time and money in

their creation. We highly recommend you bring your tax professional and

attorney to the class.

This 2 day

workshop with Dyches Boddiford and Guests; including a Trust Attorney,

Title Company representative and others will give you a broad understandning of

the various types of Trusts, many of their uses for Real Estate and also

other asset types, and also the forms needed to save you time and money in

their creation. We highly recommend you bring your tax professional and

attorney to the class.

Don't Miss this Fabulous workshop and the Fantastic FREE BONUSES for those who pre-register

For more information about the FREE bonuses and the workshop, or to register see below;

Trust Concepts & Strategies

Land Trusts and Personal Property Trusts Powerful Legal, Tax & Business Strategies for the Savvy Investor

With Author, Investor, Educator; Dyches Boddiford along with several guest experts available to answer your questions.

Sat. & Sun. July 23rd & 24th

South San Francisco,CA (right near SFO)

Two Full Days of High Quality Real World Education

Whether you have significant assets or just starting, there will be practical strategies presented that you can use that will save you many times the cost of this conference!

ARE

YOU A TARGET?

Take this Test and See for Yourself!

-

Are you in business?

-

Do you manage rentals?

-

Are you a Professional?

-

Do you live in a nice house?

-

Do you own any property?

-

Do you drive a car?

-

Do you have employees?

-

Do you invest in the market?

If you answered YES to any of the above, you're a potential target of the Urban Terrorist of the 21st Century; the "contingent fee" lawyer who can tie up your assets for years in legal proceedings.

The Solution?

REDUCE

TAXES!

ACHIEVE

FINANCIAL PRIVACY!

PROTECT

ASSETS!

AVOID

PROBATE!

BECOME JUDGEMENT PROOF!

This will be a down-to-earth, nuts and bolts class on Land Trusts and Personal Property Trust. No, they are not the be-all and end-all entity for asset protection as some teach. However, they are valuable entities to use in your asset protection plan and to conduct your business affairs.

We will even have a couple of special guests, including a Trust Attorney to answer questions you may have on the topic and a Title Company representative . We will be covering in detail the legal and tax aspects of Land Trusts and other kinds of Trusts what they really do for you and what they do not provide. This will be a reality check! And we will also discuss how Land Trusts fit into an overall business and investment plan.

Even if you have been using Trust and Land Trusts for years, this class will be of value since we will also discuss particular clauses that can strengthen your Trustâ€but they should only be used by an informed investor. And you will be an informed investor after this class.

We will cover practical, everyday techniques you can use to help bulletproof your assets as well as advanced strategies for use when you are ready. You will gain insights on methods others can use to separate you from your hard earned dollars and assets, then how to legally protect yourself.

For Example, just a few of the topics we plan to cover in detail include -

-

Myriad of Uses of the Land Trust & Personal Property Trust

-

Liability issues

-

When a Trust can owe taxes -- Complex & Simple Trusts

-

Grantor & Non-Grantor trusts and why it makes a difference

-

Land Trusts and the Due-on-Sale clause

-

Deeds into Land Trusts

-

The importance of Beneficiary Agreements

-

Trustee and fiduciary issues

-

Title holding trusts for Lease-Options and Land Contracts

-

Trusts used in estate planning

-

and much more!

Click here for the upcoming Workshop details.

June 16th 2011

Secrets to Getting your REO offers Accepted!

Secrets to Getting your REO offers Accepted!

REO's (Repossesed Real Estate Properties Owned by Banks)

continue to hit the market and many expect this to run on for several more

years as the foreclosures continue and an attempt to flush out all  of this distress inventory properties takes

place.

of this distress inventory properties takes

place.

You don't want to miss tonights meeting as we will have (2) two very active REO

agents share with us their insider secrets to constructing and presenting

your offers to lenders and asset managers and more importantly how to get them

accepted!

How to Work with an REO Agent

Topics that will be covered:

-

Understanding Current REO / Foreclosure Inventory

-

How Government Legislation Affects the Current Market

-

Predictions and Forecasting for so called Shadow Inventory

- Who is Buying? and Who is Selling?

- Do Short Sales Really Work? Why or Why not?

- How To Survive and Thrive in Today's Competitive Marketplace

- Prospering In An Ever Changing Market

- Investment Concerns in Current Market

Ty Leon-Guerrero is the Broker/ Owner of the Real Estate office,

Team1Realty. Since beginning his Real Estate career in 1994, Ty has

successfully sold and closed well over 1500 properties in the Bay Area. As an

investor, he has personally bought and sold over 200 properties as rentals,

"Fix and Flip" repositioning, and development projects. Currently, Ty is

actively involved in all phases of Foreclosure Real Estate and has the

knowledge and tools to guide prospective buyers and investors throughout any

transaction process.

Ty Leon-Guerrero is the Broker/ Owner of the Real Estate office,

Team1Realty. Since beginning his Real Estate career in 1994, Ty has

successfully sold and closed well over 1500 properties in the Bay Area. As an

investor, he has personally bought and sold over 200 properties as rentals,

"Fix and Flip" repositioning, and development projects. Currently, Ty is

actively involved in all phases of Foreclosure Real Estate and has the

knowledge and tools to guide prospective buyers and investors throughout any

transaction process.

About Joseph

McNulty – MBA and Real Estate Broker

About Joseph

McNulty – MBA and Real Estate Broker

Proven financier, businessman, executive, entrepreneur and Real Estate broker

with more than 18 years of diverse experience in the fields of residential

mortgage lending, single-family residential sales, single-family home

construction, and small business acquisitions. Expertise in marketing and

selling distressed properties and all phases of construction

projects.

BAWB May 19th, 2011 Meeting

This months BAWB meeting is a very informative

Two Part Program You Don't Want to Miss!

Part 1

California Prosperity:

Understanding Today and How to Return Prosperity to the Golden

State

Now more than ever, it is vital that our policy responses are guided by the principles that best preserve the essence of America- its entrepreueurial spirit, belief in the dignity of individuals, and vigilant defense of liberty.

- Measuring and Understanding the State's Economic Performance

- Providing Incentives and Disincentives...

- How do Taxes affect Economic Performance in California?

- Are we getting real Value-for-Money from Sacramento or is there a better way?

- Solutions for the Future and a California recovery

SPEAKER:

SPEAKER:

Jason

Clemens, Director of Research for the Pacific Research Institute.

About Jason Clemens:

Jason Clemens is

the Director of Research at the San Francisco-based Pacific Research Institute.

Prior to joining PRI he held a number of positions at the Canadian-based Fraser

Institute over a ten-plus year period. He has an Honors Bachelors Degree of

Commerce and a Masters’ Degree in Business Administration from the University

of Windsor as well as a Post Baccalaureate Degree in Economics from Simon

Fraser University. He has published over 50 major studies on a wide range of

topics, including taxation, government spending, labor market regulation,

banking, welfare reform, productivity, and entrepreneurship. He has published

over 250 shorter articles, which have appeared in such newspapers as The Wall

Street Journal, Investors Business Daily, the Washington Post, and a host of

U.S., Canadian, and international newspapers. Mr. Clemens has been a guest on

numerous radio and television programs across Canada and the United States,

including ABC News. He has appeared before committees of both the House of

Commons and the Senate in Canada as an expert witness and briefed state

legislatures in California. In 2006, he received the coveted Canada’s Top 40

Under 40 award presented by Caldwell Partners as well as an Odyssey Award from

the University of Windsor. In 2011, he was awarded (along with his co-authors)

the prestigious Sir Antony Fisher International Memorial Award for the

best-selling book The Canadian Century.

*********************************************************

PART 2

Adding Value Through Deconstruction!

Speaker: Mila Zelkha, Developer, Associate AIA,

Realtor, and owner of

Speaker: Mila Zelkha, Developer, Associate AIA,

Realtor, and owner of

Mint Condition Homes, LLC

Oakland, CA

Mila will

share her redevelopment company's unique and innovative approach as they

wrestle with the following issues:

- Is there a viable alternative to "flipping"?

- How can we offer a refreshing and thoughtful design?

- How to incorporate Green design materials & Methods

- Is there an way to create an Alternative Appraisal Market?

- Ways to effect overall market transformation...

April

21st BAWB Meeting

Tonight's discussion will be from (3) Three

different Local Investors who are Deploying Different Techniques to work our

current Marketplace.

It's a Meeting you don't want to

Miss!

The Areas to be Covered will

Include:

Trustee Sales - Buying Properties right at the Courthouse

Steps During Trustee Sale Auctions

-

What is the process- an overview

-

What properties to Target and Why

What properties to Target and Why -

Can you get Title Insurance?

-

How Do you fund such purchases

-

Are their Deals to be had?

-

Tips, Tricks, Traps, and Travesties..

WHOLESALE PROPERTIES FOR IMMEDIATE CASH

PROFITS

-

What Properties make the most sense

What Properties make the most sense -

How to find the below market deals

-

Types of Marketing to find deals with "Meat on the Bone"

-

What type of closing to orchestrate and expect

-

Making sure your buyer doesn't flake

BUYING TO SELL

OR HOLD WITH CREATIVE TERMS & NON BANK FINANCING

BUYING TO SELL

OR HOLD WITH CREATIVE TERMS & NON BANK FINANCING

-

Which properties are the best Candidates

-

How to determine value and make your offer

-

Where do the funds come from?

-

How to structure your deal with multiple exit strategies

-

Logistics, Paperwork, Realties of a Sellers Mindset

Using Private Placement Offerings to Raise Capital

Speaker: Attorney Bruce E.

Methven

Speaker: Attorney Bruce E.

Methven

Whether the need for capital is for Real Estate investment opportunities, a business concept, invention or startup;

Getting money shouldn't be difficult, but getting the right money at the right time on the right terms is what matters.

At

this Meeting – you will hear discussion on:

- The

Two Rules-

Rule No. 1: Raise money before you need it.

Rule No. 2: You always need it sooner than you think. - What is a syndication?

- What about Entities…

- Who is considered an accredited investor today?

- Common Mistakes to Learn from when trying to raise Capital

- About Sources of private lenders / investors

- What type of documentation is require in an offering

- Learn how to raise money without violating the securities laws.

- Learn when "finders" can be used to help you raise money.

- Learn the Pros and Cons of the different federal and California exemptions for raising money.

About our Speaker:

Bruce E.

Methven is the principal of Methven & Associates (www.methvenlaw.com) a

business‑law firm based in Berkeley. He graduated from Boalt Hall School

of Law

(U.C. Berkeley) in 1980.

His law firm forms business entities; structures real‑estate deals; handles securities-law work for offerings to investors; reviews contracts, leases and licenses; files trademark applications; advises on real-estate, business and employment law; handles probates, particularly those involving real estate; and represents clients in commercial litigation and arbitration.

February 17th, 2011

Claude "The

Mentor" Diamond

Claude "The

Mentor" Diamond

On

February 17th, 2011 The Bay Area Wealth Builders Association welcomes back

option investor and author Claude "The Mentor" Diamond with his new 2011

Lease Purchase Success System for California Creative Real Estate.

Claude believes in the following,

which he learned from his Mentor Max:

"Why own when you can Control?"

"No more Tenants and Terlits!"

"You make your money, up-front, in every deal."

"Life is too short to drink cheap wine and drive a used

Yugo."

"Sales, Marketing and Negotiation are the Million Dollar

Skills."

Claude

is a fellow California Investor, who for 26 years, has created a wonderful

lifestyle working out of his homes thanks to creative real estate. He

spends his time in San Diego, California, Winter Park, Colorado, NYC, NY (ya

know) and Maui, Hawaii.

Claude will discuss Lease Purchase and

Claude will discuss Lease Purchase and

wealth building Strategies including:

*How to profit up-front, every month and at the end of every deal with Lease

Purchasing*

*How to create first class notes and generate passive income with

options*

*How to consult in Creative Real Estate and generate consistent monthly cash

flow*

*How to use his unique Arbitrage Strategy -"Get a contract

and get out."*

*Sandwich Leasing-Assignments-Hybrids-Wholesaling and so much more*

*The

G.U.T.S.™ Sales-Marketing Success System-Never make a cold call again and

qualify the

prospect in 3 minutes!*.

*The

State of The State of California: When are we going to get our Sh*t

Together?*

Claude is a person committed to improving the quality of peoples' lives through

the ancient art of One-on-One Mentoring, just as his mentor

did for him.

His motto has always been "Success, One Person at a

Time".

Claude Diamond is the author of the following

books:

Lease Purchasing for the 21st Century©

The Lease Purchase Bible©

The Mentor Teaches Success©

The Mentor Teaches The G.U.T.S.™ Success System©

Consulting, Coaching and Mentoring in Creative Real Estate©

The Mentor and the Success Gauntlet© (coming in 2011)

He is

also the publisher of The Lease Purchase Times©

newsletter.

Note: Complimentary subscription for Bay Area Wealth Builders members, go

to www.TheLeasePurchaseTimes.com.

Claude and his wife Claudia are the founders of the

innovative Diamond Consulting Group. He specializes in

One-On-One Mentoring and Success Training with his innovative G.U.T.S.™ Success

Method.

Claude and his wife Claudia are the founders of the

innovative Diamond Consulting Group. He specializes in

One-On-One Mentoring and Success Training with his innovative G.U.T.S.™ Success

Method.

Claude holds a degree in business and a Juris Doctorate in Law. He addresses

investment clubs and corporations around the United States. He speaks at

national seminars and conventions on the subjects of Lease Purchasing/Creative

Real Estate, The New G.U.T.S.™ Sales System, Personal and Business

Achievement and Wealth Creation. He is the creator and producer of several

contemporary CD and DVD sets dealing with success. His most recent success

novel "The Mentor, A Story of Success" is a best seller on www.Amazon.com and www.claudediamond.com.

Be sure to visit with us!

Here's your opportunity to learn personally from the undisputed master of this Science of Wealth Creation, Personal Achievement and Peak Performance. Find out why so many people from all over the world have benefited from his unique One-On-One Mentoring Approach to Success.

BAWB Thursday January 20th 2011 Meeting

Say Good Riddens to 2010!

Out with the OLD and in with the NEW YEAR...

Is this the Right Time to Buy? Have we reached the bottom of the Market as other so called experts are saying? Is stabilization of the Marketplace near?

The January Meeting will be held in San Francisco at:

Holiday

Inn Golden Gateway

1500 Van Ness Ave

San Francisco, CA 94109

(415) 441-4000- Hotel Direct #

Start off the New Year Informed –listen and learn from our own industry expert…

Speaker: Author of Timing the Real Estate Market, Statistician,

& Investor; Robert Campbell

Speaker: Author of Timing the Real Estate Market, Statistician,

& Investor; Robert Campbell

Topic: 2011 Housing Forecast -What Will Happen & Why

Program Director Note: "Robert has spoken at our meetings in the past and has been incredibly prescient in accurately predicting California Real Estate Market trends.Don't miss his insight at this months meeting…"

***********************************************

The Campbell Method: A Proven Timing

System that Tells You EXACTLY When to Buy

and Sell Real Estate to Make Maximum Profits!

Dear Real Estate Investor:

Imagine for a moment how you would feel if you could predict major turning

points in the real estate market.

Suppose somebody handed you a 21-year time-tested system that would tell you ahead of time when property values were going to hit a peak … and then when prices were going to hit bottom years later.

If you could anticipate these kinds

of critical real estate events in advance … then not only could you make

spectacular profits, but you could protect your money as well.

Sounds pretty amazing, doesn't it?

Actually, it's not. The real estate

market does signal its future intentions if you know where to look.

Hello. My name is Robert Campbell and I wrote Timing the Real Estate

Market to help both professionals and ordinary people make the most

money in real estate with the least amount of risk.

I also have my web site; www.realestatetiming.com Based on a major breakthrough in

tracking and predicting real estate trends, my book reveals the real estate

timing technique that I call The Campbell Method .

As far as I know, The Campbell Method is the only proven method in the world that shows how to accurately anticipate upcoming changes in your local real estate market.

What this means is that when you read Timing the Real Estate Market , you are going to learn how to make – and protect – your fortune in real estate in the same way that J. Paul Getty, the Rockefellers, Warren Buffett, and other super-rich investors made their fortunes: by focusing on WHEN to buy and sell.

It's true. When it comes to making

money in real estate,

nothing beats good timing.

The reason that The Campbell Method is going to change the way you think about how to buy and sell real estate is that I share my truly remarkable discovery of five key real estate indicators. I call them "Vital Signs," and they're able to predict the peaks and valleys of real estate cycles with an almost uncanny accuracy. As "leading indicators" to what's looming on the horizon for real estate prices, these Vital Sign indicators act like windows into the future, giving you advance notice of approaching trend changes from three to six months before they become obvious to the general public.

Author's Note: Timing the Real Estate Market is used at the University of San Diego by Professor Elaine Worzala. The class: Real Estate Investment. "The logic behind these Vital Sign indicators is air-tight," says Professor Worzala. "I'm very impressed, and my students love your book."

Copies of Timing the Real

Estate Market will be available for purchase and autograph by Robert Campbell

at the meeting.

BAWB

December 16th, 2010 Meeting

NOTE: Our NEW Meeting Location Best Western Corte Madera Inn

56 Madera Blvd

Corte Madera, CA 94925

(415) 924-1502 - hotel direct

T his

is our final meeting of the year!

his

is our final meeting of the year!

DON'T MISS OUR "DOING DEALS HOLIDAY GATHERING"

This is always judged by our attendees to be one of the BEST meetings we have all year.

It's a great way to learn what others are doing, the genesis of their individual transactions, and more importantly where the profit centers are...you'll be amazed at how many different perspectives to doing a deal there are.

This

also will be a great meeting to get to better know your fellow

attendees.

This

also will be a great meeting to get to better know your fellow

attendees.

Come join us for a festive time of the year meeting and Holiday cheer in an open forum setting.

You are

invited to bring your spouse or a loved one for a night out and to better see

what our meetings are all about.

We have several BAWB members tell us their "deal story" which promises to be

informative and fun.

It's been an incredible year

filled with change, tough lessons, and successes.

It's been an incredible year

filled with change, tough lessons, and successes.

We hope some of you will share a hard lesson or success from the past year.

A Two Part Meeting:

Part 1

"A Memory is a Terrible Thing to Waste..."

"A Memory is a Terrible Thing to Waste..."

Join us tonight and don't miss out on what's guaranteed to be a highly entertaining, productive, and shall we dare say UNFORGETTABLE meeting.

Never Forget Another Name!

(or anything else for that matter)

Every computer runs faster

and better when its allowed to

operate at its full capacity.

Your Brain is no

exception. As a matter of fact,

there's no more powerful computer in the world!

How many times

has it happen to you....Where you've met someone for the first time....and no

sooner did the handshake break with that person...

AND You've

already forgotten their Name?!

Would you like to be Able to:

> Instantly recall the names of your clients and prospects?

> Remember important dates, times and appointments?

> Remember

complex lists of things you need to do or

buy...without ever having to write anything down?

> DOUBLE your

INCOME while cutting your stress in half?

> Just improve your overall memory -PERIOD?

Be sure to join us as you'll come away with a few good

Ideas on how a better memory will increase your efficiency,

productivity, and selling ability for Real Estate Investors

and have fun in the process.

**************************************************************

Part 2

Part 2

Special Mystery Speaker

The

"Japanification"

Of America!

The FED recently moved to drive down interest

rates

even lower than they already are.

How will this effect our Economy and Real Estate Values?

> Few Nations in Recent History have seen a striking reversal of

Economic Fortune as Japan

> Japan rode to Economic dominance one of the Great speculative Stock

Market and Real Estate Bubbles of all time in the

1980's.....only

to see the bubbles popped in the late 1980's and early

1990's

> For nearly a generation now the

Japanese nation has been trapped

in low growth and a corrosive downward spiral of

prices,

known as Deflation.

> Now, as the United States and other Western Nations struggle to

recover from debt and property bubble's of their own a

growing

number of Economists are pointing to Japan as a dark vision

of our future.

> Just as Inflation scarred a generation of Americans,

DEFLATION has left a deep imprint on the

Japanese.

Economists are now warning of the possible

"Japanification" of America

- the same deflationary trap of collapsed demand that occurs when

consumers refuse to consume, corporations hold back on making

investments and banks in a tight credit market sit on cash.

Join us for this insightful discussion!

BAWB

October 21st 2010 Meeting

How Sweet Deals Go Sour...

Speaker:

Real Estate Broker, Author, Expert Witness Cari Lynn Pace

Speaker:

Real Estate Broker, Author, Expert Witness Cari Lynn Pace

Cari Lynn Pace has been a real estate broker for 36 years and is in demand as a

real estate expert witness for testimony in litigation and mediation.

A former President of the Marin Association of Realtors, Pace writes and

instructs statewide courses accredited by the Department of Real Estate.

Her latest book "Don't Shoot Me...I'm Just the Real Estate Agent!"

reveals

the top 100 red flags for real estate sellers and buyers. She's

been

interviewed on ABC television, KGO radio, and many other consumer affairs

programs. Her program for BAWB is "How Sweet Deals Go Sour".  Here

are a few of the points she will cover which include:* When

selling, how can you protect yourself from lawsuits?

Here

are a few of the points she will cover which include:* When

selling, how can you protect yourself from lawsuits?

* What are the warning signs when you are buying property?

* What must your real estate agent disclose to you?

* What do real estate agents NOT have to disclose?

* What rude surprises come up when you buy a short sale?

* Why don't people buy at foreclosure sales?

* Where is all this inventory that lenders have foreclosed?

* How can you save money on closing costs?

Ms.

Pace will be available to autograph copies of her book,

available for $20 cash or check, after the program.

BAWB Monthly Meeting Thursday September 16th, 2010

NOTE: Our NEW Meeting Location Best Western Corte

Madera Inn

56 Madera Blvd

Corte Madera, CA 94925

(415) 924-1502 - hotel direct

This months Meeting will be a Multi Part Program with special added Bonus (please read below):

PART I

The "Checkbook"

IRA

LLC Attorney, Educator, Author, Radio Host;

Michael

Yesk

Michael

Yesk

* What

is the "checkbook" style IRA

* Why would you want one

* What can you invest in...

* What are the Limitations

* What are some of the Risk's & Rewards

About Michael Yesk

Michael J. Yesk is the President of Adelphi Retirement, LLC, an administrator

of Self-Directed IRA accounts. In his 24 years as an attorney Michael has

helped thousands of clients legally save millions of dollars in taxes on their

investments.

Prior to joining Adelphi, Michael was the attorney-manager of the Northern California and Hawaii region for a national Qualified Intermediary for 1031 tax deferred exchanges for 12 years. He obtained his undergraduate degree in Philosophy from the University of California, Berkeley, and his JD degree from the University of San Francisco. Mr. Yesk teaches accredited courses to investors, real estate agents, escrow officers, accountants and attorneys.

Michael is the co-author of "The Real Estate Investment Flow Chart," which helps investors get started on the road to real estate wealth, and then to move from the residential real estate investment market to the commercial real estate market with www.browndevelopments.com

Michael is currently the co-host of the radio show Going Beyond Real

Estate, www.goingbeyondrealestate.com. Michael spent 5 years as the host

of the popular Sunday morning radio show Rock, Roll and Real Estate www.rockrollandrealestate.com

Michael is currently the co-host of the radio show Going Beyond Real

Estate, www.goingbeyondrealestate.com. Michael spent 5 years as the host

of the popular Sunday morning radio show Rock, Roll and Real Estate www.rockrollandrealestate.com

PART II

WHAT IS WORKING NOW?

Audience members will share their take on what they are curently doing in today's uncertain marketplace and their strategies for the coming months.

Listen and learn invaluable insights and tips from your fellow attendees about the techniques they are deploying to survive and thrive in our market.

BONUS SESSION:

If you are dealing with Property sellers and customers who are facing

foreclosure you often fall under California Civil Code Section 1695.

There is a special "Home Equity Sales Contract" which must be used under these circumstances to comply. However even the existing CAR- California Association of Realtors approved contract contains some defective flaws surroudning the way it was drafted and its language you need to be aware of.

Find out What those potential "mine fields" are and how to avoid them!

BAWB Monthly Meeting Thursday August 19th, 2010

NOTE: Our NEW Meeting Location

Best Western Corte Madera

Inn

56 Madera Blvd

Corte Madera, CA 94925

(415) 924-1502 - hotel direct

Why the Housing Market

Hasn't Recovered…

The Eisenhower Years

From a historical standpoint many people look back at the Eisenhower years when Dwight David Eisenhower served as President for eight years from 1953 to 1961 as a "quiet" era. During Dwight's time in office, home ownership was on the rise. The average home sold for $22,000.00. Guess where Mortgage rates were at that time?

You guessed right…. About where they are today! Mortgage interest rates were in the mid 4 % range.

A Perspective

Let's put this into a perspective for you. The last time mortgage interest rates were this low a first class postage stamp was 3 cents, the average income in the U.S. was $3,960.00 per year, a Ford automobile cost $1,548-$2,415, bread was .17 cents a loaf, a T-bone steak was .95 cents per pound, etc. Also they had Nickel & Dime stores not Dollar stores.

Today's home buyers are enjoying rolled back prices; sellers who are willing to pay some buyers closing costs, and interest rates at historic lows- BUT many of them are still not buying….WHY?

Four years after the housing bubble popped, the American real estate market has yet to launch a sustainable recovery. Although U.S. home prices have improved modestly since the spring of 2009—and certain regional markets have performed even better—sales and values will face renewed downward pressure later this year in the wake of the expiration of the federal home buyer tax credits. Indeed, some analysts expect the bloated inventory and sputtering demand to trigger a "double dip" housing recession, with prices possibly even slipping back below their April 2009 lows.

This disconcerting outlook has materialized despite some optimistic developments within the market. The 30-percent drop in real estate prices has helped restore affordability to a once wildly-overvalued market, putting additional consumers in position to become homeowners. Meanwhile, mortgage financing as pointed out above has grown downright cheap—with rates falling to 50-year lows.

So what's the problem then?

What's causing this stagnation in the housing recovery?

Attend this months meeting to find out why the housing market hasn't recovered, and how you as a savy investor can take advantage of the opportunities which will continue to present themselves.

July 15th,2010 Meeting

Building Wealth One

House at a Time

Speaker: Author,

Investor, Educator Extraordinaire;

Speaker: Author,

Investor, Educator Extraordinaire;

John Schaub

This is one meeting you simply MUST attend! - bring your spouse, family member,

business associate, or a loved one - they will be glad you did.

Why Should you Listen & Learn From John Schaub?

"The best investment you can make: knowledge you can use today"Today

you have a unique opportunity to buy investment houses that will produce large

profits for years to come. The changing market produces a short-term

opportunity to buy good properties at deeply discounted prices. Low interest

rates make it possible to buy these properties on terms that will produce

immediate profits. Lenders, both institutional and private, are awash in loans

in default and with properties they now own. They are renegotiating loans and

wholesaling properties. It is your opportunity to buy several prime properties

at bargain prices or on great terms. Be a picky buyer!The future for real

estate is bright. Inflation will dramatically drive up prices and rents. Take

advantage of this opportunity - learn to buy and finance property today that

will pay you profits for a lifetime.

ABOUT JOHN SCHAUB:

Nationally known real estate expert John Schaub learned his craft in the

best way possible: 35 years on the job, investing in every kind of real estate,

dealing with every twist of the economy and managing hundreds of tenants.

John's unique focus on investing in single-family homes in quality

neighborhoods enables his readers and students to accumulate wealth while

providing affordable housing for families.

John has survived eight Presidents and prospered for 30 years as a landlord. He

authored the original single family house seminar in 1976 which launched

thousands on their way to successful investing. He is still an active buyer and

engaged in managing his business and investments, when not traveling with his

family, or building homes for Habitat for Humanity.John is a reformed "Big

Deal" guy, who discovered that most of the big talkers had small bank balances.

John stresses keeping it simple. He talks only about what he has done and what

has worked and sometimes not worked for him. John spends nearly all of his

working time making deals and managing his properties. He teaches only three

seminars a year.

Join John Schaub & Management Expert David Tilney

for this fantastic 2 Day Workshop - Sat. & Sun. July 17th & 18th at the

South San Francisco Conference Center

CREATING CASH DURING UNCERTAIN TIMES

How to survive and thrive in Real Estate

today

For more information on this workshop click here

Take Advantage of the Limited Time to Pre-Register for the Discounted Workshop Tuition & FREE Bonuses - Do it Today!

BAWB Meeting June 17 th 2010

Topic:

Specialists (hired

guns)

Specialists (hired

guns)

Wikipedia states: A Specialist frequently refers to an expert in a profession.

There are certain incidents or problems which often seem to crop up when trying to buy or sell Real Property where an escrow is involved.

These might involve title flaws, occupancy, ingress and egress issues, boundary lines, and Permit, Pest, Roof, & Home inspections, dealing with the new lead paint rules and so on….

Knowing who you can contact as a so called "Specialist" can often keep the escrow Alive and an actual closing together versus your deal falling apart.

This

months meeting will introduce you several local specialists (or Hired Guns as

we like to refer to them as) who can assist you when that moment arrives and

you need to seek out their help!

This

months meeting will introduce you several local specialists (or Hired Guns as

we like to refer to them as) who can assist you when that moment arrives and

you need to seek out their help!

Don't miss this opportunity to learn from our panel of "Specialists"

Workshops in 2002: | August | October |

BAWB May 20th 2010 Meeting

HOW TO KEEP WHAT YOU'VE GOT IN SPITE OF HYPERINFLATION OR DEPRESSION

Always willing to

share his thoughts and often Controversial...

Always willing to

share his thoughts and often Controversial...

John T. Reed, Author, Investor, Publisher

From his New Book:

"How To Protect Your Life Savings from Hyperinflation and Deflation"

John will discuss and cover:

• Why Federal spending is a Runaway train

• Why the government only has five choices when investors stop buying U.S. Bonds to Finance our deficits: the most probable is Hyperinflation

• Hyperinflation and Depression will wipe out certain persons and groups financially and leaves others unscathed and sometimes better off- Which Group are you in?

• There is still time to get out of the way of this runaway train but you must consider certain steps...find out which steps to take NOW!

•

Why the following do NOT protect you from hyperinflation:

TIPs, Savings Bonds, Gold, and Cost-of-Living clauses

• Why even Real Estate & Common Stocks are unreliable when it comes to protecting you from hyperinflation and depression

• Learn why Foreign Currencies, Bonds, & Stocks offer little protection

• Why Liquidity is Crucial and often Overlooked: You gotta be both Wealthy and Liquid to STAY Wealthy

•

What it comes down to Is having the RIGHT mindset and types of Assets

& Debts—if you got ‘em, you're a spectator to

hyperinflation/depression; if not, you become a

victim

About John T. Reed: John T. Reed is a self-publisher of books and a national newsletter on real-estate investment, and books on football coaching and baseball coaching and self-publishing. He has been a columnist on football coaching for American Football Quarterly magazine. He has sold over 160,000 books and 3 million newsletters. He has been quoted regularly in the national news media since the 1970's and has appeared on numerous radio and TV shows including Larry King Live, Good Morning America, and 60 Minutes. He was a real-estate investor for 23 years. He also worked as a bartender, property manager, real-estate salesman, banker, football coach, and volleyball coach. He has been married since 1975 and has three sons.

He was an Army officer in the U.S. and Vietnam and graduated from Army Airborne (paratrooper) and Ranger schools. Mr. Reed holds a Bachelor of Science degree from West Point and a Master of Business Administration degree from Harvard Business School.

BAWB April 15th, 2010 Meeting

What is Working Now?

Join us for a Panel discussion with several local investors who will share their insights about what is currently working for them in this protracted downtrodden Real Estate market.

- REO's - is all the "low hanging fruit" gone?

- Are Foreclosures for the bottom feeders...

- Credit & Investor Capital and where to obtain it

- Should you be a BUY & HOLD investor

or BUY & SELL dealmaker...?

- How to negotiate, structure, and put together the deal

- What are their projections for the foreseeable future?

- Lots of Q & A and your chance to get your questions

answered

Join Us and Find out!

Invite a business associate, friend, family member or loved one to attend as this promises to be a very informative meeting you don't want to miss!

BAWB March 18th, 2010 Meeting

After the Fall: Saving capitalism from Wall Street—and Washington

SPEAKER: Author, Nicole Gelinas

But it doesn't have

to be this way.

But it doesn't have

to be this way.

You see the government gradually adopted a "too big to fail" policy for the largest or most complex financial companies, saving lenders to failing firms from losses. As a result, these companies became impervious to the vital market discipline that the threat of loss provides.

Adding to the problem, Wall Street created financial instruments that escaped other reasonable limits, including gentle constraints on speculative borrowing and requirements for the disclosure of important facts.

The financial industry eventually posed an untenable risk to the economy—a risk that culminated in the trillions of dollars' worth of government bailouts and guarantees that Washington scrambled starting in late 2008.

Even as banks and markets seem to heal, lenders to financial companies continue to understand that the government would protect them in the future if necessary. This implicit guarantee harms economic growth, because it forces good companies to compete against bad.

History and recent events make clear what Washington must do.

First, policymakers must reintroduce market discipline to the financial world. They can do so by re-creating a credible, consistent way in which big financial companies can fail, with lenders taking their warranted losses. Second, policymakers can reapply prudent financial regulations so that markets, and the economy, can better withstand inevitable excesses of optimism and pessimism. Sensible regulations have worked well in the past and can work well again.

Don't miss this incredibly informative meeting!

About Nicole Gelinas:

Nicole Gelinas is the Searle Freedom Trust Fellow at the Manhattan Institute and a contributing editor of City Journal. Gelinas writes on urban economics and finance, municipal and corporate finance, business issues, and crime. She is a Chartered Financial Analyst (CFA) and a member of the New York Society of Securities Analysts.

Copies of her book will be available for purchase and autograph at the meeting.

In After the Fall, Nicole Gelinas shows how the financial crisis that began in 2008 was not a failure of markets, but a failure of government to understand its proper role in markets.She explains how Washington helped bring on the economic crisis in two ways: through its "too big to fail" policy, and by its failure to apply proven, prudent regulatory principles to modern financial markets and firms. In the absence of market discipline and prudent regulation, the government is now deciding which companies and people should receive investment capital, and on what terms—harming our economic competitiveness.

BAWB February 18th, 2010 Meeting

A TWO (2) PART MEETING YOU MUST NOT

MISS!

PART # 1 -

Author & CalWatchdog's Editor in Chief; Steven

GreenhutAuthor

of the Book:"Plunder! How Public Employee Unions are Raiding

Treasuries, Controlling Our Lives and Bankrupting the Nation."His Op-Ed

article for the Wall Street Journal; "Plundering California" is a must

read. Here is the link:http://liberty.pacificresearch.org/press/plundering-california

PART # 1 -

Author & CalWatchdog's Editor in Chief; Steven

GreenhutAuthor

of the Book:"Plunder! How Public Employee Unions are Raiding

Treasuries, Controlling Our Lives and Bankrupting the Nation."His Op-Ed

article for the Wall Street Journal; "Plundering California" is a must

read. Here is the link:http://liberty.pacificresearch.org/press/plundering-california

- The 2010 California Budget shortfall is projected to be $20B or more!

- This Shortfall is larger than the entire state budgets of all but a handful of other States

- The California Legislature continues to use budget gimmicks, including unrealistic assumptions of new revenue and accounting tricks employed to effectively borrow from future year.

- California as a state enacted the largest tax increase ever imposed by any statehouse in the history of America. The results were predictable: Like the tax increase of 1991, California plunged deeper into recession and produced less revenue.

- The inability of politicians to restrain their spending of taxpayer dollars is the direct result of the forceful application of political power. And, in California, there are no greater political influences than thepublic employee unions.

To make a difference, lovers of liberty ought not only to buy Steven

Greenhut's book, but buy several copies to distribute to friends and

family.

To win the battle, we have to educate voters and Plunder! will

not only educate, it will enrage. And in this case, a little rage is a

good thing.Don't miss this opportunity to listen to Steven Greenhut

LIVE! - books will be available for purchase and

autograph.

About Steven Greenhut:

Steven Greenhut is director of PRI's Journalism Center, which will be

launched in January 2010 to provide in-depth news coverage of

California government, with a focus on uncovering waste, fraud and

misuse of taxpayer dollars.

Previously, Greenhut was deputy editor and columnist for The Orange

County Register in Santa Ana, Calif. He joined the Register's editorial page staff in 1998, after serving as

editorial page editor of The Lima News, a daily newspaper in

northwest Ohio. Both newspapers are owned by Irvine-based Freedom

Communications. He is author of the 2004 book, "Abuse of Power: How the

Government Misuses Eminent Domain." His columns have been published in

newspapers across the country including the Wall Street

Journal.

In 2005, Greenhut won the Institute for Justice's Thomas Paine Award

for his writing promoting freedom. He is a senior fellow at the

Goldwater Institute in Phoenix. His new book on public employee unions

will be out in November. It is titled, "Plunder: How Public Employee

Unions are Raiding Treasuries, Controlling our Lives and Bankrupting

the Nation." He graduated from George Washington University, is married

and has three daughters.

PART # 2 - Author, Investor, Exchangor, Educator; Jack Shea

Co-Authored the Book;

Land Trust's For Privacy & Profit

*************************************

About Jack Shea:

About Jack Shea:

Jack Shea was raised in Chicago and attended the University of Illinois where he received a BS degree in Engineering with a minor in business. He spent seven years as an Air Force pilot flying four-engine transports. He was an aircraft commander and flight examiner, and lived in France and Japan. He spent over ten years in the aviation and technology industry serving as head of marketing, and as an officer for several New York Stock Exchange corporations.